Choose from the nation's best insurance providers

Workers’ compensation insurance

Workers’ compensation insurance

Workers’ compensation insurance covers medical costs and lost wages for work-related injuries and illnesses. This policy is required in almost every state for businesses that have employees.

What is workers' compensation and why is it important for small businesses?

Workers’ compensation insurance covers costs related to workplace injuries and illnesses, which can escalate quickly due to the high cost of medical care.

While workers’ comp laws vary by state, small businesses typically need a policy in place as soon as they hire their first employee (or a certain number of workers).

Even when not required by law by your local Department of Labor or other governing body, this policy provides important protection against healthcare expenses and employee lawsuits related to workplace injuries, such as a slip and fall in the office, an injury from tools or machinery, or an occupational illness.

You can also rely on workers’ comp if an employee needs medical treatment or time off due to a workplace injury – or if an injured employee sues you for failing to prevent an accident.

If you don’t carry workers’ comp insurance, your business will be responsible for any medical bills and legal fees. Most states levy costly penalties for noncompliance.

Small businesses find workers’ comp essential for three reasons:

- Most states require workers’ comp coverage

- It covers medical expenses and partial lost wages due to a job-related injury

- Most workers’ comp policies also cover the cost of employee lawsuits related to a work injury

What does workers' compensation insurance cover?

Medical expenses

Workers’ compensation insurance covers the cost of immediate medical care for workplace accidents, such as ambulance rides, medical provider visits, emergency room trips, surgical procedures, and other medical bills. It also covers ongoing care, such as medications and physical rehabilitation.

Disability benefits

A serious injury can prevent an employee from returning to work for days, weeks, or even months. Workers’ comp benefits cover part of the wages lost while an employee is recovering from a workplace injury or occupational disease or illness.

Compensation for fatal injuries

When a work-related incident is fatal, workers’ compensation pays death benefits that cover funeral expenses and help support the deceased individual’s family members.

Lawsuits related to workplace injuries

Workers’ compensation insurance typically includes employer’s liability insurance. This type of insurance protects employers from lawsuits related to work injuries.

For instance, a worker might claim that a lack of basic workplace safety led to their injury. If the worker sues their employer, this coverage would pay for:

- Attorney’s fees

- Court costs

- Settlements or judgments

How much does workers’ compensation insurance cost?

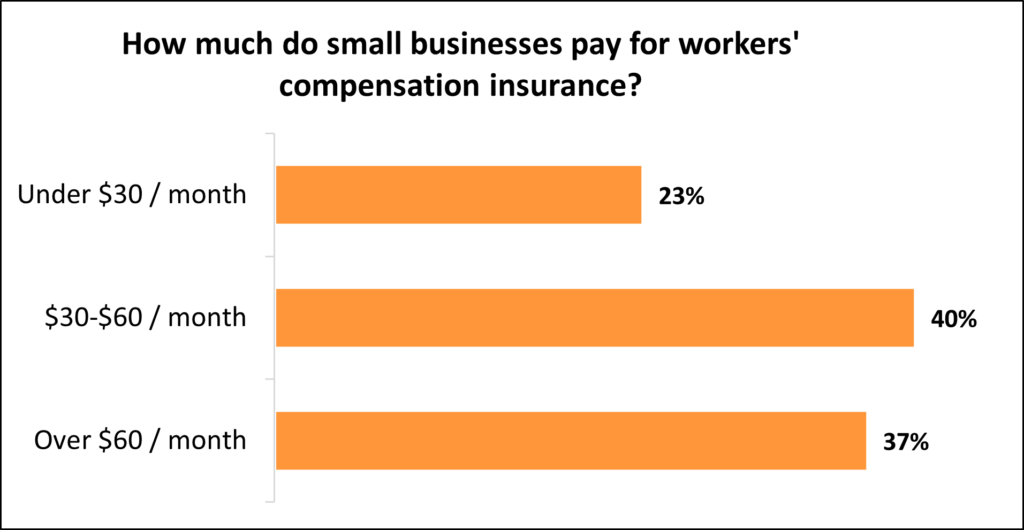

Workers’ compensation insurance policies cost an average of $45 per month. 23% of Insureon’s small business customers pay less than $30 per month for this policy.

Your workers’ comp cost is calculated based on a few factors, including:

- Payroll

- Location

- Number of employees

- Industry and risk factors

- Coverage limits

- Claims history

Is workers’ comp insurance required by law?

Each state has unique workers’ compensation laws and penalties, which are usually set by a state workers’ compensation board.

In most states, workers’ comp is required as soon as a business hires its first employee. Other states don’t mandate coverage until a business has two, three, four, or more employees. There are sometimes exemptions for certain types of workers and business structures – such as real estate agents and agricultural workers.

Subcontractor coverage requirements vary by state, but many businesses choose to get workers’ comp regardless to navigate the potential risk to all employees.

Texas and South Dakota are the only states where business owners are never required to purchase workers’ compensation insurance coverage.

All other states impose penalties for not carrying workers’ compensation. These can range from fines to jail time – or both.

Most states allow business owners to buy workers’ compensation insurance from private insurers or use self-insurance plans. North Dakota, Ohio, Washington, and Wyoming require employers to purchase workers’ comp insurance through a state fund.

How to get workers' compensation insurance

Swift helps a wide range of businesses get the coverage they need from top-rated U.S. insurance carriers. Complete our easy online application to get free insurance quotes.

Our expert insurance agents can help you choose the best workers’ compensation coverage that meets the needs of your small business.

You’ll typically be able to get coverage quickly and receive a copy of your workers’ compensation insurance certificate on the same day.

Do self-employed business owners and independent contractors need workers’ comp?

Typically not by law. States generally require businesses with employees to purchase workers’ compensation insurance.

But sole proprietors, independent contractors, single member limited liability companies (LLCs), and other self-employed business owners with no employees may buy this policy to fulfill the terms of a contract.

Your clients don’t want to deal with the expense and hassle of a workplace injury. That’s why they might require contractors who work for them to carry their own business insurance, including workers’ comp.

Some states, such as California, require businesses engaged in hazardous work to have workers’ comp coverage for all individuals, regardless of whether they are sole proprietors or independent contractors.

Workers’ comp can also help protect your income. Most health insurance policies exclude coverage for work-related injuries and illnesses, so if you carry workers’ comp as an independent contractor, your medical bills will be covered when you’re injured on the job.

Additionally, workers’ comp can partially replace wages lost while taking time off to recover from a work-related injury.

Find workers' compensation insurance quotes

Top professions that need workers' compensation insurance

What does workers' compensation insurance not cover?

Injuries caused by intoxication, drugs or company policy violations

If an employee is under the influence of alcohol or drugs and gets injured due to intoxication, workers’ compensation benefits would not apply.

Injuries claimed after firing or layoff

If an employee gets injured or makes claims of injury after experiencing a termination (including being fired or laid off), they might not be eligible for workers’ compensation benefits. A worker typically must be an active employee at a company in order to receive workers’ compensation coverage.

Wages for a replacement worker

If your employee is unable to work due to injury and you have to bring on a replacement worker, workers’ compensation would not cover the replacement worker’s salary. The injured employee would still be entitled to wage loss benefits.

OSHA fines

OSHA requires workplaces that operate heavy machinery, such as manufacturers, to follow set safety guidelines. In the event that an employee gets injured for not following OSHA safety procedures, the company may receive noncompliance fines that would not be covered by workers’ comp.

Protect your business with the right general liability policy

FAQs about workers' compensation insurance

Get answers to frequently asked questions about workers’ comp insurance.

Does workers' compensation insurance help cover fatal accidents?

Yes, most workers’ compensation policies include death benefits. These help a deceased employee’s loved ones and dependents pay funeral and burial costs after a fatal workplace accident.

Workers’ comp can also provide financial assistance for the deceased employee’s family.

Does workers' compensation protect against employee lawsuits?

In many states, yes. Most workers’ compensation policies include employer’s liability insurance to protect your business if an injured worker files a lawsuit against you for not preventing a workplace accident.

However, business owners in North Dakota, Ohio, Washington, and Wyoming do not have employer’s liability insurance included in workers’ comp.

These states are known as the four monopolistic workers’ comp states, in which workers’ comp coverage must be purchased from a state fund, and does not include employer’s liability coverage. Insurance providers sell stop gap coverage to protect you from employee lawsuits.

How can small business owners save money on workers' comp insurance?

To save money on workers’ comp, it’s important to make sure you classify your employees correctly. Employees with desk jobs or other jobs with a low risk of injury cost less to insure.

By ensuring each worker is properly classified as either a contractor or an employee (full-time or part-time), and listed under the appropriate class code, you can save money and avoid potential legal action.

In some cases, small business owners can choose to buy pay-as-you-go workers’ compensation. This type of workers’ comp policy has a low upfront premium, and lets you make payments based on your actual payroll instead of an estimated payroll. It’s useful for businesses that hire seasonal help or have fluctuating numbers of employees.

In addition, some business owners may be eligible for a minimum premium workers’ compensation policy, which sets your premium charges at the minimum premium (i.e., the smallest amount of money that an insurance company will sell to a business). Small businesses that benefit from this type of policy often have few risks and a small number of employees.

Finally, businesses with a good Experience Modification Rating (EMR) and a documented safety program can help lower workers’ comp costs. A safer workplace means fewer accidents, which helps keep your premium low.

What is the difference between general liability and workers' comp insurance?

Both policies deal with bodily injuries. General liability insurance protects your company when a client or another third party suffers an injury on your property and sues for medical expenses.

Workers’ comp insurance covers expenses resulting from employee injuries sustained while working.

Does workers' compensation cover employees who contract COVID-19?

It typically depends on where an employee contracted COVID.

Workers’ comp insurance protects employees from on-the-job injuries and illnesses. If an employee is exposed to the coronavirus because of their job, then this policy should provide coverage.

For example, a nurse caring for sick patients or a grocery store worker who deals directly with the public would both have a stronger claim than an office worker. Workers’ comp doesn’t cover diseases unrelated to employment.

Your state’s laws could potentially help cover costs related to COVID-19. If you think you might be eligible for a workers’ compensation claim, contact your insurance agency’s claims department.

Workers' compensation insurance cost

The cost of workers’ compensation insurance varies based on a number of factors about your business. Your premium is directly impacted by your business location, the number of employees you have, industry risks, and more.

What is the average cost of workers' comp insurance for small businesses?

Small businesses pay an average of $45 per month, or $542 annually, for workers’ compensation insurance.

Our figures are sourced from the median cost of policies purchased by Insureon customers from leading insurance companies. The median offers a better estimate of what your business is likely to pay because it excludes high and low premium outliers, like high-risk installation businesses that pay much more for workers’ compensation.

The average workers’ compensation claim is $41,353, according to the National Safety Council. By comparison, paying for a workers’ compensation policy that covers medical expenses, disability benefits, death benefits, and other costs related to a workplace injury, is probably a much better deal for your business. That’s why small business owners may purchase it even when it’s not required by state law.

How much does workers' compensation insurance cost for Swift Insurance customers?

While Swift’s small business customers pay an average of $45 monthly for workers’ compensation coverage, 23% pay less than $30 per month and 40% pay between $30 and $60 per month. The cost depends on your type of business, its location, your claims history, and the number of employees you have.

How are workers’ compensation insurance premiums calculated?

Your workers’ compensation insurance premium will depend on the following factors:

- The state(s) where your employees work

- The number of employees you have

- The type of work done by your employees

- Your total annual payroll

- Your workers’ comp claims history

- Your industry

Physically demanding work usually results in higher premium rates – so does a history of workplace accidents. Workers’ comp rates are unique because they tend to decrease over time, as overall workplace safety continues to improve.

How does location influence the cost of workers’ comp insurance?

The state where your employees work can have a big impact on the workers’ compensation premium you’ll pay. Each state has its own workers’ compensation laws, and each state has a rating bureau that sets the baseline rate used in calculating how much you’ll pay in insurance premiums.

Some states also run their own insurance funds that sell workers’ compensation insurance. In four states – North Dakota, Ohio, Washington, and Wyoming – businesses are required to buy their workers’ comp policy from the state fund, also called a monopolistic state fund.

Just as most states require by law that businesses with employees purchase workers’ comp, they also typically mandate that small business owners carry commercial auto insurance if they have business-owned vehicles.

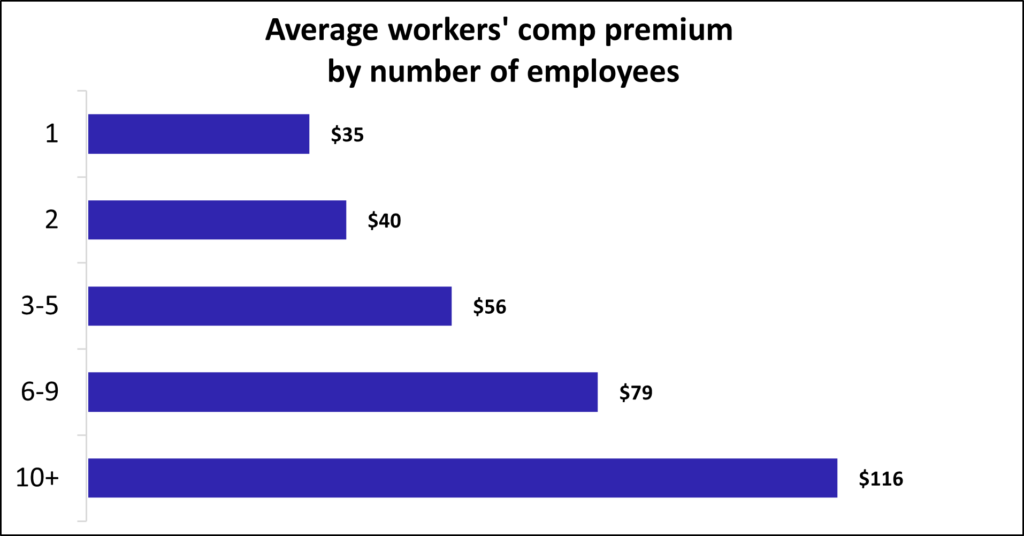

How does the number of employees affect workers' comp premiums?

Businesses with a larger number of employees pay more for workers’ comp. As your business grows, the odds that one of your employees could get injured at work go up, and so do your workers’ compensation rates.

What other factors affect the cost of workers' comp coverage?

Your payroll, worker classifications, and claims history also influence your premium.

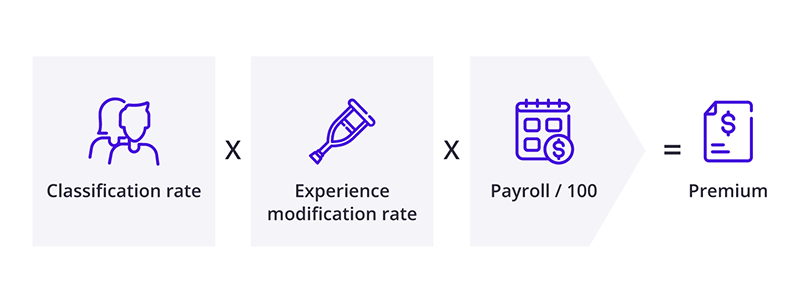

The amount you pay for workers’ compensation is a specific rate for every $100 of your company’s total payroll. Your workers’ comp premium is calculated based on the type of work done by your employees (classification rate), your experience modification rating (claims history), and your payroll (per $100).

Workers’ compensation insurance rates vary by state, ranging from a low monthly average of $32 in Texas to $119 in Alabama. However, these numbers are deceptively simple. They include all types of jobs, which means they don’t reflect the different workers’ comp costs for low-risk versus high-risk work.

What is the formula to calculate workers’ compensation premiums?

The formula for calculating a workers’ comp premium is:

Many states set their workers’ comp rates based on guidance from the National Council on Compensation Insurance (NCCI), a workers’ compensation insurance rating and data collection bureau. NCCI analyzes trends and makes recommendations based on data from millions of claims and policies. It also has information on how workers’ compensation insurance premiums are calculated in many states.

The NCCI has a searchable database of workers’ comp class codes online. Insurance companies use these classification codes to determine the level of risk for different job classifications, estimate workers’ compensation rates, and set premiums.

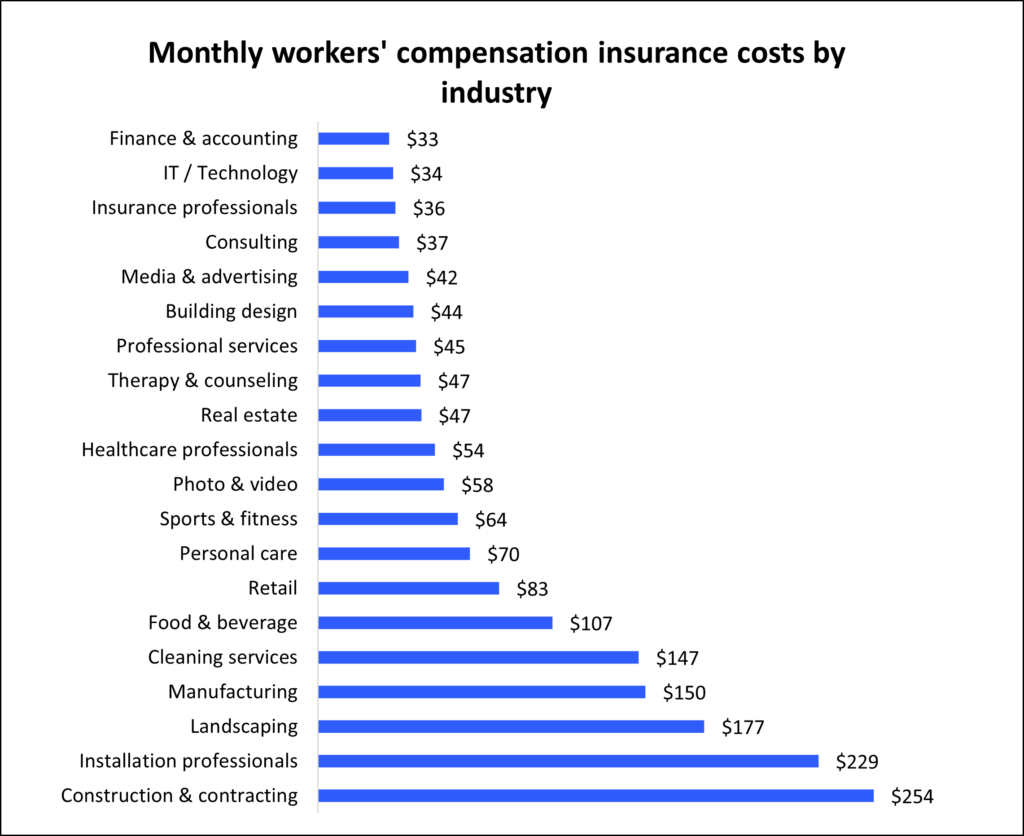

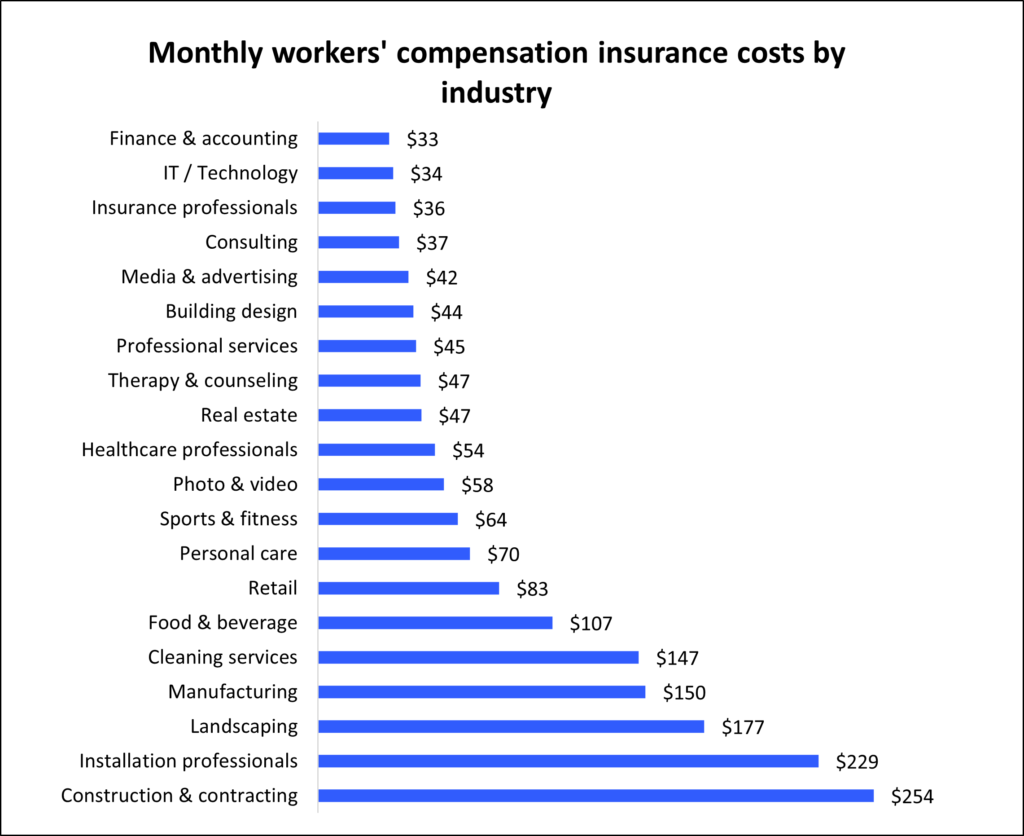

How does your industry impact workers’ comp insurance costs?

About 20% of worker fatalities in private industry occur in construction. The higher risk of an on-the-job accident means construction companies pay higher premiums. Likewise, businesses in an industry like finance and accounting have low premiums, because there’s minimal risk of a work-related injury.

Depending on the industry that you work in, such as construction or cannabis, you may also be required by your state to carry general liability insurance. For other businesses, such as those in real estate, insurance, or healthcare, you may need professional liability insurance (also called errors and omissions insurance) before you can get a license.

Below is the average cost of workers’ compensation coverage across different industries:

Top industries we insure

How do you buy workers’ compensation insurance?

In most states, you can purchase workers’ compensation insurance coverage from a private insurer. With Insureon, you can compare workers’ compensation quotes from top U.S. insurance carriers.

Fill out our easy online application and we’ll send you workers’ comp quotes that fit your business needs and budget. A licensed insurance agent is available to answer any questions you might have and will help you find the right coverage.

How can you save money on workers' comp?

Though you can’t change your industry or the type of work your employees do, there are steps you can take to keep your workers’ comp premium low.

Keep in mind that having coverage often saves you money in the long run. Beyond the obvious benefit of shielding you from medical care bills, proof of insurance can help you land contracts with potential clients. That’s why some business owners who might be exempt still choose to carry coverage, such as independent contractors and sole proprietors.

Here are a few strategies to help you reduce your workers’ comp costs.

Improve workplace safety

To create a safer work environment and reduce the risk of work-related injuries, you can:

- Conduct employee training: Train employees on how to safely do their jobs, from proper lifting techniques to correct handling of hazardous materials.

- Outfit your employees with the right gear: Equip employees with safety equipment and properly maintain tools to help minimize risks.

- Identify any potential hazards: Use signs and labels to alert workers of potential safety issues, such as dangerous chemicals or slippery floors.

- Create a clutter-free workplace: Hallways, work areas, and exit routes should be free of debris and clutter like power cords and boxes to avoid tripping hazards.

Pay your insurance premium annually

When you purchase a workers’ compensation insurance policy, you have the option of paying monthly or annual premiums. Consider paying your premium in annual installments, as many insurers offer discounts to businesses that pay annually.

Get a “pay-as-you-go” insurance policy

For some small businesses, it may be more cost effective to get a pay-as-you-go workers’ comp policy. This type of policy offers flexible premiums that change throughout the year, depending on changes to your number of employees and your payroll data throughout a 12-month span.

Obtain a minimum premium workers’ compensation policy

Some small business owners may be eligible for a minimum premium workers’ compensation policy, which sets your charges at the lowest premium that an insurance company can offer a business. Small businesses that benefit from this type of policy often have few risks and a small number of employees.

For business owners who don’t have any employees, such as independent contractors or sole proprietors, you may be eligible for a minimum premium policy called a workers’ compensation ghost policy.

State laws for workers’ compensation

Because state laws regulate workers’ comp, you’ll need to research the laws in your state to find the requirements for your business or consult with a licensed Insureon agent.

Each state sets workers’ compensation requirements

Workers’ compensation is regulated on the state level, and each state has its own requirements and penalties. Nearly every state requires employers to carry workers’ compensation insurance.

Typically, the number of employees determines when a business needs workers’ compensation insurance. Most often, it’s required as soon as you hire your first employee.

Some states have severe penalties for not carrying workers’ comp insurance

The penalty for not purchasing workers’ comp insurance when it is required varies by state. It can result in a fine, jail time, or both.

States with severe penalties include:

California: In California, it is a criminal offense to not provide workers’ compensation for your employees. It’s punishable by up to a year in jail and a fine of no less than $10,000 – or both. Illegally uninsured employers could face a penalty of up to $100,000.

Illinois: An employer who did not provide workers’ comp when it was required must pay $500 for each day of noncompliance, with a minimum fine of $10,000.

New York: Illegally uninsured employers could be charged with a misdemeanor or a felony. Fines range from $1,000 to $50,000, in addition to a penalty of $2,000 for every 10 days without coverage.

Pennsylvania: In Pennsylvania, intentional noncompliance is a felony of the third degree. It can result in a fine of $15,000 and up to seven years in jail.

In some states, you must purchase workers’ compensation insurance from a state fund

Some states have workers’ compensation state funds. Businesses in the following states must purchase workers’ compensation from the state fund, which in this case is called a monopolistic state fund:

- North

- Dakota

- Ohio

- Washington

- Wyoming

Workers’ compensation purchased from a monopolistic state fund does not include employer’s liability insurance. Typically included in workers’ comp, this insurance protects against lawsuits claiming a worker was injured by an employer’s negligence. Businesses can purchase stop gap coverage to close this gap in coverage.

Cheap workers' compensation insurance

There are several ways your small business can save money on workers’ compensation insurance, including correctly classifying your employees, managing workplace risks, and more. Learn how you can pay less for workers’ comp and still protect your business.

How can I find cheap workers' comp insurance?

Workers’ compensation insurance protects you, your employees, and your business in the event of a workplace injury or illness. Required in most states, workers’ comp covers medical expenses and lost wages for employees who are injured or get ill on the job.

Starting at $20 per month, a workers’ compensation insurance policy can be affordable for small businesses.

There are many ways for you to keep costs low. For example, you can compare rates from different insurance companies, such as through Insureon’s easy online application that retrieves quotes from trusted carriers.

In addition, correctly classifying your employees, choosing pay-as-you-go or lower premium plans, and managing your risks to avoid insurance claims can also help you pay less.

1. Shop around and compare workers’ comp quotes

Swoft carriers often offer different types of coverage options with a wide range of prices. And while you could reach out to each insurance company directly to ask for quotes on their workers’ compensation insurance policies, there’s an easier, faster way.

You can work with a digital insurance agency—like Insureon—to get workers’ comp quotes from top-rated providers, such as The Hartford and Chubb, with a single online application.

Swift’s licensed insurance agents are available to help you customize a policy for your business’s unique needs, making sure you meet state laws and your industry’s requirements.

Plus, an experienced agent can help you set appropriate limits, recommend endorsements that match your risks, and let you know which add-ons you can safely skip. Without expert help, you might not know if the policy provides too much coverage, or not enough.

Once you select the workers’ compensation policy you need, you can get coverage and a certificate of insurance (COI) in less than 24 hours.

How much does workers’ compensation insurance cost?

The average cost of workers’ compensation insurance for Insureon’s customers is $45 per month.

Workers’ compensation insurance premiums are calculated based on several factors, including:

- Payroll

- Location

- Number of employees, including contractors and subcontractors

- Industry and risk factors

- Coverage limits

- Claims history

2. Ensure your employees are classified correctly

The National Council on Compensation Insurance (NCCI) is an organization that gathers data and helps establish workers’ comp insurance rates based on the type of work you and your employees perform.

The Council utilizes more than 700 workers’ compensation class codes to denote the amount of risk and hazard each job might entail, assign a value based on these conditions, and help insurance providers determine the cost of workers’ comp policies.

It’s important for business owners to audit their workers’ comp classifications as new employees are hired, current employees are promoted, business duties are reassigned, or employees leave the company.

Whether intentional or accidental, misclassifying one of your workers could lead to overpaying for your insurance policy, or underpaying. This could lead to hefty fines and penalties, and an outstanding balance owed to the insurance provider after the premium recalculation.

By ensuring each worker is properly classified as either a contractor or an employee (full- or part-time), and listed under the appropriate class code, you can save money and avoid potential legal action.

3. Choose a pay-as-you-go workers’ compensation plan

Pay-as-you-go workers’ compensation insurance offers flexible premiums that change throughout the year. These premiums rely on any changes to your number of employees, as well as your payroll data over the course of one year.

This is a great option for small business owners looking to pay less for workers’ comp, since the initial down payment is likely to be more affordable than a traditional plan.

What’s more, it’ll reduce the guesswork in estimating your insurance costs. Every time you run payroll, you’ll know exactly how it affects your insurance rates.

4. See if you qualify for a lower premium policy

There are two types of lower premium policies: a minimum premium workers’ comp policy and a ghost policy.

Both fulfill the obligation to carry a workers’ compensation policy. However, a ghost policy provides zero workers’ comp coverage, and the availability of these policies is dependent on the state your business operates in.

Minimum premium workers’ comp policy

A minimum premium policy is the lowest premium an insurance company will sell a policy for, regardless of your payroll or amount of coverage.

For small business owners, this could mean your premiums would be the same if you expanded from one to two employees.

Workers’ compensation ghost policy

A ghost policy is ideal for self-employed business owners or sole proprietors with no employees who need to show proof of workers’ compensation insurance coverage to either win a new contract or satisfy a state requirement.

This type of policy covers no one and provides no healthcare benefits. It only offers a certificate of insurance (COI).

5. Manage your risks for affordable workers' compensation insurance

In most cases, a safer working environment equates to fewer workers’ compensation claims against your business, as well as a lower insurance premium.

There are several ways you can promote workplace safety and minimize injuries:

- Establish safety procedures and training to reduce workplace accidents

- Provide the proper gear and require adequate footwear

- Post hazard signs and labels

- Maintain tools and equipment and a clean workspace

- Consider ergonomic furniture and equipment

Businesses with good safety records will see this reflected in a low Experience Modification Rating (EMR Rating), which translates into lower rates for their workers’ compensation coverage.

An EMR is one way for insurance carriers to adjust their premiums, based on the expected losses from workers’ comp claims for each company they insure.

The average EMR is 1.0, which means a business is no more or less risky than similar businesses in their profession. A higher rating would mean a riskier business and higher premium, while a lower rating would mean a less risky business and lower premium.

Top professions that need workers' compensation insurance

How do state laws impact workers' compensation insurance requirements?

Since workers’ compensation is regulated on the state level, each state has its own requirements and penalties.

Workers’ compensation insurance is required in nearly every state, and some states require employers to buy workers’ compensation insurance through a state insurance fund.

These states require all workers’ comp policies be purchased through a state fund:

- North Dakota

- Ohio

- Washington

- Wyoming

However, there are a few exceptions. In some cases, specific types of workers and business structures, such as independent contractors and limited liability companies (LLCs), are exempt from carrying workers’ comp insurance.

Also, South Dakota and Texas are different than most other states because workers’ compensation insurance isn’t generally mandated. Employers without this coverage usually must notify the state and their employees.

Even though your business might be able to save money by not buying workers’ compensation, it’s usually a good investment. Private health insurance won’t cover any work-related injuries or illnesses, which could leave you on the hook for expensive medical bills.

It’s important to note that some states mandate workers’ comp insurance based on your profession. For example, Florida workers’ compensation law states that even self-employed workers in the construction business must have workers’ compensation insurance.

Most policies include employer’s liability insurance, which protects your business against lawsuits from injured workers.

Cheapest industries to purchase workers' compensation insurance

Generally speaking, industries that have a higher risk of employee injury or illness can expect to pay a higher premium.

For example, an electrician who handles dangerous electrical wiring on a daily basis will likely pay more for their workers’ compensation coverage than a tax preparer who works on their laptop from a home office.

Among Insureon customers, industries such as finance and accounting, IT / technology, and insurance tend to pay less compared to higher risk industries like construction and installation.

Here’s a look at workers’ comp insurance costs for different types of business professions:

What doesn't workers' comp insurance cover?

While workers’ compensation insurance covers medical care expenses for injured employees and offers death benefits for fatal accidents, it doesn’t protect your small business against other types of risks.

You may also need the following small business insurance policies:

General liability insurance: This covers common business risks like customer bodily injuries, damage to a customer’s property, and advertising injuries.

Commercial auto insurance: This policy covers vehicles owned by your business and is required in nearly every state. It typically pays for accidents, vehicle theft, weather damage, and vandalism.

Professional liability insurance / errors and omissions insurance (E&O): If you provide professional advice or services to clients, you likely need this policy. Professional liability and E&O can be affordable while protecting your business if you’re accused of a mistake, oversight, or professional negligence.

Business owner’s policy (BOP): A business owner’s policy bundles general liability insurance with commercial property insurance to protect against liability claims and property damage. It generally costs less than buying these two policies separately.

Cyber insurance: This policy helps small businesses recover financially from data breaches and cyberattacks. It’s recommended for any business that handles credit cards or other personal information.

Get affordable workers' compensation insurance with Swift Insurance

Complete Swift’s easy online application today to find cheap workers’ compensation insurance coverage from top-rated U.S. companies. You can also consult with an insurance agent on your business needs, including how to find affordable general liability and commercial auto insurance.

Once you find the right types of insurance for your small business, you can begin coverage and receive your certificate of insurance in less than 24 hours.