Choose from the nation's best insurance providers

Errors and Omissions Insurance

Errors and Omissions Insurance

Errors and omissions insurance (E&O) helps cover the cost of a lawsuit if a client claims your work was inaccurate, late, or never delivered. It’s sometimes called professional liability insurance.

Why is errors and omissions insurance important?

If you provide professional advice or services to clients, you likely need this policy.

Your clients might require errors and omissions insurance in the terms of a contract. And it’s strongly recommended for professionals who make a living off their expertise.

E&O insurance, also called professional liability insurance or professional indemnity insurance, protects your business if you’re accused of a mistake, oversight, or professional negligence.

This policy will cover legal defense costs related to the lawsuit, including court costs, settlements, and judgments. You’ll typically pay a deductible, and your insurance provider will pay legal expenses up to your coverage limit.

Three reasons E&O insurance is important for small businesses:

- Fulfills contractual obligations

- Some states require it for specific professions

- Covers legal defense costs up to your policy limit

What does E&O insurance cover?

Most E&O claims are straightforward, such as failing to deliver a product or service as promised. However, claims of professional negligence can be more complicated.

When a client hires you to provide a specialized skill, they’re entitled to a reasonable standard of care. If you deliver inadequate work, the client can sue for professional negligence.

Specifically, errors and omissions insurance coverage includes:

Work mistakes and oversights

Even a small professional error or oversight could end up costing a client money. When the client tries to recoup their losses by suing your business, errors and omissions insurance helps pay for attorney’s fees and other legal costs.

Undelivered services

If your business leaves work unfinished, it can interrupt your client’s business plans. When you fail to deliver promised services, a client could sue – especially if it negatively impacts the client’s bottom line.

Missed deadlines

If your business misses a deadline, it could delay your client’s business plans and result in lost revenue. If a client sues your business over late work, errors and omissions insurance can cover the cost of the lawsuit.

Cybersecurity and data leaks

There’s a specific policy bundle for IT and tech professionals that combines errors and omissions insurance with cyber insurance into one policy: tech E&O. This coverage protects professionals against the risks and legal expenses associated with data breaches and other cybersecurity threats.

A standard E&O policy alone will generally not cover these risks, making the bundled E&O policy a great fit for those who work in tech.

Breach of contract

A client could accuse you or one of your employees of breaching a contract by failing to provide the service as agreed upon. Depending on the severity of the breach, this could potentially result in a lawsuit. E&O insurance would protect your business from an accusation of a breach of contract.

Misrepresentation

If a client accuses you of making a false statement to secure a contract, such as exaggerating your level of experience or knowledge of a subject, the client could sue your for misrepresentation. If a buyer thinks a realtor falsely described the conditions of a building or a neighborhood, they might seek compensation in court.

How much does errors and omissions insurance cost?

Your cost is based on a few factors, including:

- Amount of coverage

- Claims history

- Industry risk factors

- Number of employees

- Business size

- Day-to-day operations

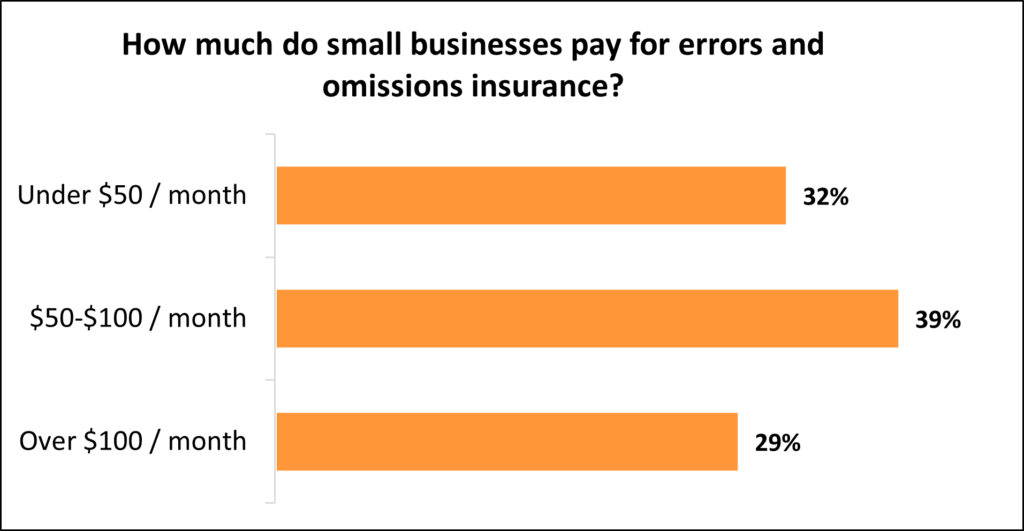

E&O insurance costs an average of $61 per month. 32% of Insureon’s small business customers pay less than $50 per month for their policy.

Who needs errors and omissions insurance?

Errors and omissions insurance benefits a variety of industries that provide services directly to a client or customer. It is designed for both businesses and independent contractors that make a living off of their expertise.

Some professionals may need this coverage to work for a certain client or to comply with state laws. Industries that often require E&O coverage include:

IT professionals

IT professionals typically buy technology errors and omissions insurance (tech E&O), which includes both E&O insurance and cyber insurance. This bundle protects against lawsuits over contract disputes, coding errors, and data breaches.

Some clients will only work with tech companies that can prove they have an active E&O insurance policy, even if they have cyber insurance.

For instance, a client hires an IT consultant to protect their customer data, but a data breach exposes the names and credit card details of thousands of customers. The client believes the IT consultant should have been able to prevent the incident and files a negligence lawsuit.

Insurance agents

E&O coverage for insurance agents can protect against an oversight that left a client vulnerable to liabilities. It also covers bad advice that led to inadequate coverage. Some clients may require proof of E&O insurance before they agree to work with you. It’s also required in some states, depending on the type of work you do.

For example, an insurance agent fails to procure adequate auto insurance coverage for a client, despite promising to do so. When the client gets in an accident and goes to make a claim, they’re surprised to find themselves uninsured. They sue the insurance agent for failing to secure the appropriate coverage.

Real estate agents

Some states require errors and omissions insurance for real estate agents and brokers. This policy helps pay for lawsuits over failure to close, mismanagement, disclosure errors, or other professional issues. Unless you can prove you carry an E&O policy, some clients, buyers, or sellers may refuse to work with you.

For instance, a real estate agent makes an error on an MLS sheet, incorrectly listing a home’s square footage as more than it is. The homebuyer realizes the error after purchasing the home and sues the agent. The real estate agent’s E&O policy covers the cost of hiring a lawyer and the eventual court-ordered judgment.

Professional services

Many professionals, such as notaries, travel agents, and recruiters, make their living by advising others based on their industry knowledge and expertise. A mistake, such as poor advice or a miscalculation, can result in negative consequences that can impact the business or even result in a lawsuit.

Errors and omissions insurance can support professional service providers in the event that a client is unhappy with the services provided.

Tax preparers

E&O insurance for tax preparers covers the costs of lawsuits over missed deadlines, accounting errors, or lost documentation. This policy offers indirect protection for the client if there’s a mistake in their taxes. That’s why some clients will ask for proof of insurance before they’ll use your financial services.

For example, a tax preparer fails to file a client’s tax return before the deadline and now the client is forced to pay a costly fine. To recoup the fine, the client sues the tax preparer for missing the filing deadline.

Top professions that need errors and omissions insurance

How do I get proof of errors and omissions insurance?

Complete our easy online insurance application to get free quotes from top-rated providers. Insureon’s expert insurance agents can help you choose the best errors and omissions coverage for your business’s needs.

You can typically get coverage quickly and receive a copy of your errors and omissions insurance certificate on the same day you apply for quotes.

What does errors and omissions insurance not cover?

While errors and omissions insurance covers many aspects related to legal action from a client, it does have a number of coverage exclusions. For example, it only covers the cost of defending against lawsuits – it doesn’t pay for lawsuits you initiate. Also, mistakes that are made intentionally are not covered.

Unless your policy has prior acts coverage, it will only cover any claims filed while the policy is active and for incidents that occurred after you bought the policy. In this case, endorsements can fill gaps in your errors and omissions coverage.

Other exclusions and exposures from errors and omissions insurance coverage include:

Customer injuries and property damage

If you accidentally damage a client’s property or a client is injured at your office, general liability coverage will help pay for the client’s property repairs or medical care. This policy can also cover your legal expenses if the client sues.

Employee injuries

If an employee suffers a work-related injury or illness, workers’ compensation insurance can cover their medical expenses, as well as partial lost wages for the time they take off work.

Employee discrimination lawsuits

If a job candidate or employee sues your business for harassment, discrimination, or wrongful termination, then employment practices liability insurance (EPLI) can cover the cost of your legal fees, as well as the cost of a settlement or judgment.

Illegal activity

E&O insurance will not provide coverage for activities that were illegal or misleadingly harmful. Intentional wrongdoings generally do not fall under the umbrella of what insurance will cover.

Damage to business property

If your business property is damaged, destroyed, stolen, or lost, then a commercial property insurance policy can pay to repair or replace the affected items.

Vehicles used by a business

Most states require commercial auto insurance for all business-owned vehicles. If your business uses personal or rented vehicles instead, you’ll need to purchase hired and non-owned auto insurance (HNOA).

Harm caused by a product

Product liability insurance covers costs if a product made, sold, or distributed by your small business injures a customer or damages their property. It’s usually included in general liability insurance.

Get free errors and omissions insurance quotes

FAQs about errors & omissions insurance

Review answers to common questions about E&O insurance.

When do you need errors and omissions insurance?

Small business owners may be required to carry errors and omissions insurance in the following situations:

- Your state might require it for your profession. For example, some states mandate a certain amount of E&O coverage for real estate agents.

- Clients might ask you to buy E&O insurance. In many fields, clients might ask you to carry an E&O policy in order to protect themselves against potential legal costs. You may need to produce a certificate of insurance to show that you’re insured and to sign a contract.

- E&O coverage is beneficial, and often required, for licensees. Depending on the type of work you do, your state licensing board might require you to carry E&O insurance as part of its licensing requirements.

Even when it’s not required, E&O insurance is a key part of risk management. Without it, a simple mistake or oversight could lead to a lawsuit that could devastate your business.

How does errors and omissions insurance work?

Errors and omissions insurance covers legal defense costs related to accusations that you failed to meet expectations or were negligent in your work.

You’ll need to contact your insurance company in order to make an errors and omissions claim. It’s a good idea to have the relevant information on hand, such as your policy number and details about the incident.

Be aware that errors and omissions insurance is a claims-made policy. That means your policy must be active both at the time of the incident and when the claim is filed in order to benefit from coverage.

When you buy an E&O policy, you can set a retroactive date to secure coverage for work you’ve done in the past. With this type of insurance, it’s important to maintain continuous coverage so you don’t end up paying for legal fees out of pocket.

Is there a difference between errors and omissions insurance and professional liability?

This coverage has a few names, but they all refer to the same policy. Different types of businesses use different terms:

- E&O insurance: This is the preferred term for insurance agents, real estate agents, tax preparers, and IT professionals.

- Professional liability insurance: Architects, consultants, construction companies, and photographers use the term professional liability insurance.

- Malpractice insurance: The term legal malpractice insurance is used by lawyers, while doctors and other healthcare professionals refer to it as medical malpractice insurance.

How does errors and omissions insurance differ from general liability insurance?

Most small businesses can benefit from carrying both general liability and E&O insurance, as these policies protect against different types of lawsuits.

You can look to a general liability policy for protection against common accidents, such as customer slip-and-fall injuries or accusations of slander. These types of liability claims can happen at any business.

On the other hand, an errors and omissions insurance policy will cover claims of professional negligence, not bodily injuries. You’ll want to consider this coverage if your work could harm a client’s finances. It’s recommended for businesses that provide professional services or expert advice to clients.

Where can I learn more about errors and omissions insurance?

You can find answers to other common questions about E&O insurance in our frequently asked questions about errors and omissions insurance.

For questions about coverage, you can also contact an Swift agent who can discuss your coverage options and give you insurance quotes from trusted providers.

Errors and omissions insurance cost

The cost of errors and omissions insurance (E&O), also called professional liability coverage, varies based on a number of factors about your business. Your premium is directly impacted by your industry, the type of work you do, and more.

What is the average cost of errors and omissions insurance?

Small businesses pay an average premium of $61 per month, or about $735 annually, for errors and omissions insurance.

Our figures are sourced from the median cost of policies purchased by Swift Insurance customers from leading insurance companies. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Typical errors and omissions insurance costs for Swift Insurance customers

While Swift’s small business customers pay an average of $61 monthly for errors and omissions insurance, 32% pay less than $50 per month for their policies, and another 39% pay between $50 and $100.

The cost varies for small businesses depending on their types of risks and the coverage they choose.

Understanding errors and omissions insurance cost factors

How do policy limits affect errors and omissions insurance costs?

If you want an errors and omissions insurance policy that covers more expensive lawsuits, you’ll need higher limits – which means you’ll pay a higher price.

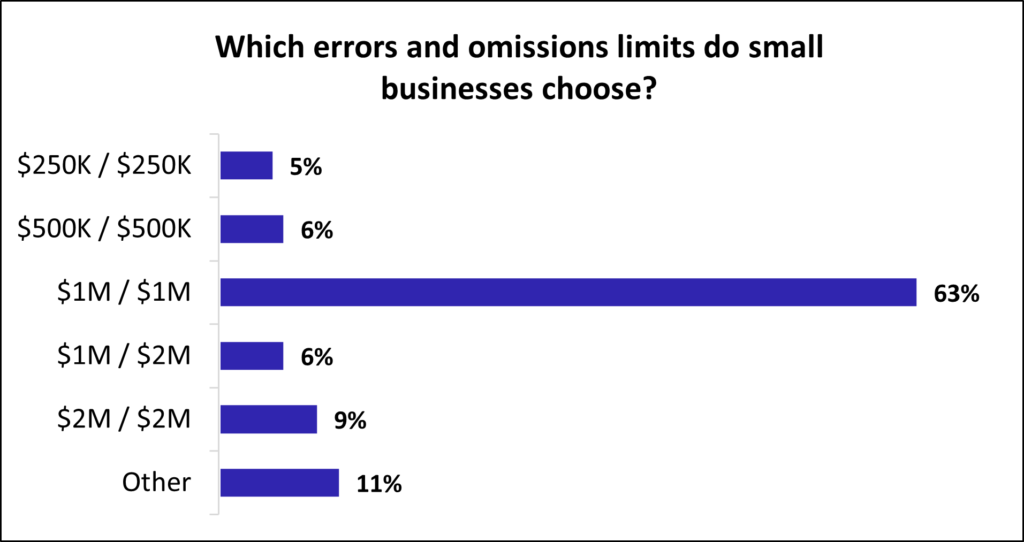

The limits on E&O coverage vary significantly, from $250,000 to $2 million. Errors and omissions coverage with $1 million / $1 million limits is the most popular option for small businesses. This includes:

- $1 million per-occurrence limit. While the policy is active, the insurance company will pay up to $1 million to cover any single claim.

- $1 million aggregate limit. During the lifetime of the policy, the insurer will pay up to $1 million to cover E&O claims.

The majority of Swift Insurance customers (63%) choose E&O insurance coverage with $1 million / $1 million limits. Nine percent of our customers choose an E&O policy with $2 million / $2 million coverage limits, the next most popular choice.

When buying a policy, it’s a good idea to make sure the deductible is something you can easily afford. If you can’t pay for it in a crisis, your insurance won’t activate to cover your claim. The average deductible that Insureon customers select for errors and omissions insurance is $2,500.

The right amount of coverage depends on your business needs. You want coverage that’ll cover a potential lawsuit, without buying more than you need. Chat with a licensed insurance agent if you’re unsure which limits are right for your business.

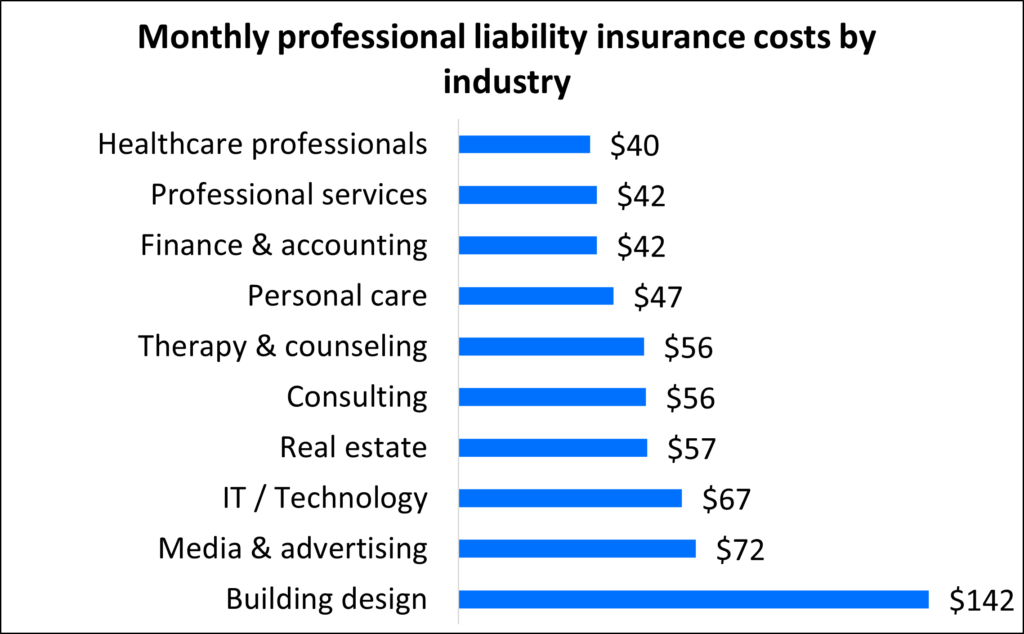

How does your industry impact the cost of E&O insurance?

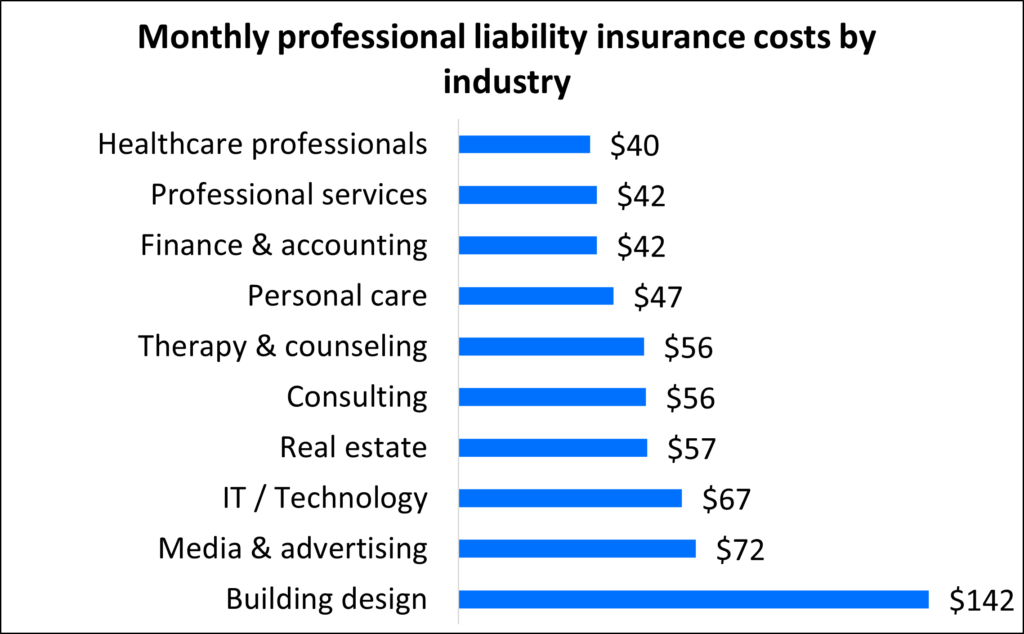

Our analysis of errors and omissions insurance costs reveals that for small businesses, your industry has the biggest impact on your premium. Generally, insurance providers charge higher risk businesses higher premiums, while lower risk industries enjoy lower rates.

For example, building design professionals, such as architects and engineers, are exposed to more risk than photographers or accountants. A mistake could lead to problems with the stability of a building, or cause an injury if a structure collapses.

Depending on your state and your profession, you may need E&O coverage to get licensed or to work in your field. That can include real estate agents, insurance agents, lawyers, and doctors.

The graph below illustrates how the type of business affects what you’ll pay for an errors and omissions insurance policy.

Top industries we insure

E&O insurance provides affordable, necessary protection for professional services

Errors and omissions insurance is a must-have for small businesses that provide expert advice or services, such as IT consultants-+ or professional services. You may see it referred to as professional liability insurance or malpractice insurance depending on the industry.

Experts can still make mistakes or oversights, or give professional advice that causes financial loss for a client. If the client sues, attorney’s fees, court costs, and other legal expenses can escalate to the point where they could sink your business.

Even if you’ve done nothing wrong, you’re not immune to lawsuits. For example, your business could lose a key individual who you need to complete a project on time, or a client could sue over a budget overrun that was out of your hands.

When someone sues your business – even if it’s a frivolous lawsuit – you’ll have to pay legal defense costs, including the cost of hiring an attorney. If you lose the suit, you could end up paying a fortune in a court-ordered judgment or a settlement.

Errors and omissions insurance covers all of these costs, which could save your business from bankruptcy. Because the premium is based upon your level of risk and your industry, many small businesses pay only a small monthly premium for this coverage.

How can you save money on E&O insurance?

It’s possible to reduce your E&O premium through a few simple steps:

Shop around. Insurance companies offer a range of errors and omissions premiums and coverages. Compare quotes from different carriers with Insureon’s easy online application.

Pay your entire premium upfront. Policyholders can choose to pay insurance premiums once a month or once a year. While making a smaller payment each month requires less money up front, it may cost more in the long run. Insurers often offer discounts to businesses that pay an annual premium.

Bundle policies. Depending on your industry, it’s sometimes possible to bundle errors and omissions insurance with another policy, such as general liability insurance. For example, tech professionals can buy E&O insurance and third-party cyber liability insurance together in a bundle called tech E&O. This often costs less than purchasing each policy separately.

Keep continuous coverage. Continuous coverage is key if you don’t want to pay out of pocket for E&O lawsuits. While it’s possible to purchase coverage when you start a project and drop coverage when you complete the project, this cost-cutting strategy can backfire for errors and omissions and other claims-made policies. To file a claim, your insurance must be active:

- When an alleged mistake occurs

- When the claim is filed

Reduce your risks. Your errors and omissions claims history is a big factor when calculating your premium, which is why it’s important to avoid lawsuits in the first place. Many errors and omissions lawsuits stem from client disputes. To reduce the risk of hefty legal fees, you can:

- Strive to meet the standard of care for your industry

- Communicate clearly, especially when an issue arises

- Document all contracts and communications with clients

Why do small business owners choose Swift?

Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Cheap errors and omissions (E&O) insurance

Your small business can save money on errors and omissions insurance by avoiding claims and choosing a higher deductible, among other methods. Learn how you can pay less on E&O and still get the protection you need.

How do I find cheap errors and omissions (E&O) insurance?

Errors and omissions insurance (E&O), also known as professional liability insurance or malpractice insurance, is an important policy for small businesses that give professional advice or provide professional services to clients.

E&O coverage protects your business from financial loss in the event that a client claims your mistake or oversight cost them money. This includes paying for defense costs and other legal fees.

Starting at $33 per month, errors and omissions insurance can be affordable for small businesses.

There are many ways for you to keep costs low. For example, you can compare rates from different insurance companies, such as through Insureon’s easy online application that retrieves quotes from trusted carriers.

In addition, bundling your E&O policy with other insurance products, selecting cost-saving options on your errors and omissions insurance coverage, and keeping your claims history clean can also help you pay less.

1. Shop around and compare quotes from multiple insurance carriers

Different insurance companies will offer different prices for errors and omissions insurance. Some may even specialize in serving your industry and offer more affordable policies with tailored protection.

You could reach out to insurance companies directly and ask for quotes on their errors and omissions policies. Thankfully, there’s an easier method.

You can work with a digital insurance agency—like Insureon—to get errors and omissions quotes from top-rated providers, such as The Hartford and Chubb, with a single online application.

Swift’s licensed insurance agents can help you navigate different coverage options to find an affordable E&O policy that meets all your needs. Plus, they can ensure the policy you purchase provides the coverage you need to fulfill contracts, meet legal requirements, or reduce risks common to your profession.

You can begin coverage and get a certificate of insurance on the same day.

How much does errors and omissions insurance cost?

The average cost of errors and omissions insurance for Insureon’s customers is $61 per month.

Your cost is based on several factors, including:

- Coverage limits

- Claims history

- Industry risk factors

- Business size

- Day-to-day operations

- Number of employees

2. Bundle your E&O insurance with other policies, when possible

Insurance companies often give discounts when you bundle multiple policies together. This includes your errors and omissions policy.

Tech and IT companies can often combine their E&O coverage and cyber insurance in a bundle called technology errors and omissions insurance, or tech E&O.

A tech E&O policy provides liability coverage related to:

- Oversights and mistakes

- Failure to deliver promised IT services

- Accusations of professional negligence

- Third-party cyber insurance (data breach lawsuits)

- Intellectual property and media liability (for certain professions)

Top professions that need errors and omissions insurance

3. Customize your E&O policy to reduce costs in the long-term

Even though most errors & omissions policies provide similar coverage, you can customize your policies in unique ways to save more money.

This includes:

Choosing higher deductibles

A deductible is the amount of money you must pay toward a claim before your insurance benefits kick in. Say an E&O lawsuit costs a total of $50,000 and your deductible is $5,000. The insurance policy will cover $45,000, after you have paid the $5,000 deductible.

When it comes time to choose an insurance policy, the deductible should be an important factor in your decision. In general, higher deductibles mean lower premiums. The trade-off is that in the event of a claim, your business is responsible for paying a larger share up front.

A higher deductible might be worth it if you’re mostly concerned about unlikely but very expensive claims.

If a claim does occur, the amount you pay towards the deductible might be insignificant compared to what the insurance policy covers. On the other hand, smaller losses that are less than your deductible may not be covered at all under the policy.

Paying your entire premium upfront

You can choose to pay your insurance premiums once a year rather than on a monthly billing cycle. While making a smaller payment each month requires less money upfront, it often costs more since insurers often offer discounts to businesses that pay an annual premium.

Keeping continuous coverage

While it’s possible to purchase omissions coverage when you start a project and drop coverage when you complete the project, this cost-cutting strategy can backfire.

To collect insurance benefits, your “claims-made” E&O policy must be active:

- When an alleged mistake occurs

- When the claim is filed

In short, continuous coverage is key if you don’t want to pay out of pocket for E&O lawsuits.

4. Keep your claims history clean

As with auto insurance, a claim on your E&O policy can cause your premium to go up. Insurance companies may also be reluctant to insure a business with a lengthy record of claims, unless that business is willing to pay more.

Fortunately, you can take steps to reduce the likelihood of an E&O claim. Errors and omissions claims often arise from disagreements with clients. Clear communication, detailed contracts, and other measures can help you and your clients stay on the same track.

By keeping your claims history clean, you will reduce your losses. Having direct and straightforward conversations with clients, while also maintaining other controls, can help prevent potential losses.

Cheapest industries to purchase errors and omissions insurance

In addition to your location, your industry can affect how much you pay for an E&O insurance policy. Generally speaking, industries that face greater consequences if a mistake or negligence occurs can expect to pay a higher premium.

For example, an architect who is responsible for building a new high rise will likely pay more for their errors and omissions insurance coverage than a photographer who takes family pictures.

Among Insureon policyholders, industries such as professional services, insurance, and finance and accounting tend to pay less compared to higher risk industries like building design and media and advertising.

Here’s a look at errors and omissions insurance costs for different types of business professions:

What doesn't errors and omissions insurance cover?

While errors and omissions insurance covers court costs and other legal fees over a client lawsuit related to unsatisfactory work, it does not provide complete protection.

Other insurance products to consider include:

General liability insurance: A general liability policy covers common business risks like customer bodily injury, damage to a customer’s property, and advertising injury.

Commercial auto insurance: This policy covers vehicles owned by your business and is required in nearly every state. It typically pays for accidents and damages related to theft, weather, and vandalism.

Workers’ compensation insurance: Workers’ comp is required in almost every state for businesses that have employees. It can cover medical expenses for work injuries, which are not often covered by regular health insurance.

Business owner’s policy (BOP): A business owner’s policy bundles general liability insurance with commercial property insurance to protect against liability claims and property damage. It generally costs less than buying these two policies separately.

Employment practices liability insurance (EPLI): This policy covers defense expenses if an employee sues your business for harassment, discrimination, or wrongful termination.

How to get errors and omissions insurance quotes from trusted carriers with Swift

Complete Swift’s easy online application today to find affordable errors and omissions insurance coverage from top-rated U.S. companies.

At any point while completing our application, you can consult with an insurance agent on your business insurance needs, such as any endorsements you should consider adding to your omissions insurance policy or how to find affordable workers’ comp and commercial auto policies.

Once you find the right types of insurance programs for your small business, you can begin coverage and receive your certificate of insurance in less than 24 hours.