Choose from the nation's best insurance providers

Commercial Umbrella Insurance

Commercial Umbrella Insurance

Once a policy’s limit is reached, commercial umbrella insurance provides additional coverage for liability claims made on general liability, commercial auto, or employer’s liability insurance.

Why is commercial umbrella insurance important for small businesses?

Business owners who purchase commercial umbrella insurance usually need it to fulfill a contract that requests higher than standard policy limits offered by an insurance company.

Commercial umbrella insurance offers extra liability coverage for the most expensive lawsuits. For example, if a covered lawsuit maxes out your general liability insurance policy but you still owe money for damages, business umbrella coverage can provide additional funds to make up the difference.

Umbrella liability insurance can supplement your coverage provided by:

- General liability insurance

- Employer’s liability insurance (often included in workers’ compensation)

- Commercial auto insurance or hired and non-owned auto (HNOA) insurance

Commercial umbrella insurance can boost coverage for any (or all) of these policies in $1 million increments. Before you can purchase umbrella liability insurance, however, an insurer will require you to carry a certain amount of coverage for the underlying policy.

Businesses that buy umbrella insurance coverage:

- Have insurance but need to close the gap on requirements above $2 million

- Have high liability risks, such as a business location with a lot of foot traffic

- Need more liability protection across several policies

What does commercial umbrella insurance cover?

Commercial umbrella insurance policies have the same terms and cover the same risks as the underlying business insurance policy.

Specifically, umbrella insurance can help provide additional coverage for the following:

Slip-and-fall injuries

When you add commercial umbrella insurance to your general liability insurance, it can cover your legal expenses if someone gets injured on your business property.

Third-party property damage

When you add commercial umbrella insurance to a general liability policy, it helps pay for legal bills related to destroyed or damaged third-party property.

Car accident liability

Adding commercial umbrella insurance to a commercial auto insurance or hired and non-owned auto insurance policy helps cover costs if someone sues for damages caused by your vehicle.

Commercial auto insurance is required for businesses that own company vehicles in most states, such as Texas and New York.

Employee injury lawsuits

When you add commercial umbrella insurance to employer’s liability insurance (typically included in workers’ compensation insurance), it helps pay for employee lawsuits over work injuries.

How much does commercial umbrella insurance cost?

For Insureon customers, commercial umbrella insurance costs on average about $75 per month for each $1 million of additional coverage.

Several factors affect umbrella policy costs, including:

- Industry and risk

- Coverage limits

- Location

- Number of employees

- Number of vehicles

How does commercial umbrella insurance work?

Think of commercial umbrella insurance coverage as a safety net. Your other liability policies are your first line of defense.

When you need an added layer of protection on a claim that exceeds the limits of your primary policy, your business umbrella insurance can pick up the slack.

No matter your type of business, you may need extra protection from your risk exposures. The higher limits offered by an umbrella policy are one of the most affordable insurance solutions available to give you the peace of mind you need.

Here’s when you need it

Let’s say you have a commercial general liability policy with a $2 million per-occurrence limit, which means it can pay up to $2 million toward your legal expenses.

If a client suffers a serious injury after tripping and falling at your business and decides to sue, the medical bills, legal fees, and damages could add up to $2.5 million. After hitting your general liability limit, you would still have a $500,000 bill.

Here’s how it helps cover expenses

An umbrella liability policy can help cover the expenses that exceed your underlying policy’s limit. For the case above, a business umbrella policy would cover the additional $500,000.

Basically, you can make a claim on umbrella insurance when each of the following occurs:

- Your business is sued over third-party bodily injury or property damage.

- The cost of the lawsuit is more than the limit of the underlying coverage.

Who needs a commercial umbrella policy?

Commercial umbrella insurance used to be a policy that only big businesses bought. These days, more small businesses invest in commercial umbrella insurance due to the rising cost of lawsuits and medical expenses.

You should consider an umbrella liability policy if:

You want to sign a big client who requires more liability insurance

Umbrella coverage helps close the gap on contract requirements over $2 million.

For example, if a general contractor is bidding for a project and the client contract requires a general liability policy with a $5 million per-occurrence limit, an umbrella policy of $3 million would be added to the contractor’s existing $2 million general liability policy.

You have lots of contact with the public

The more foot traffic a business has, the greater its liability risks.

For example, if a customer trips on an uneven step at your restaurant and sustains serious injuries that leave them with a chronic health problem, they could decide to sue for $3 million in damages to recoup the cost of medical expenses.

If your restaurant’s general liability policy has a per-occurrence limit of $2 million, umbrella insurance would cover damages beyond the initial $2 million, up to the umbrella policy’s limits.

Your business owns vehicles

A business with a fleet of vehicles might want coverage to protect against the cumulative costs of minor vehicle accidents.

For example, if a window installer driving a company van to a job site accidentally causes a pile-up, the other drivers could decide to sue for damages.

An umbrella liability policy would cover the window installation business’s legal defense costs once the auto policy is maxed out. It would also cover damages paid to other drivers in the form of a settlement or court-ordered judgment.

Your work is hazardous

The more hazardous the work, the greater the risk of employee injury – especially in industries such as construction or installation.

For example, a long-time employee at an HVAC installation company sues her employer over a chronic back injury she receives from lifting heavy equipment.

An umbrella liability policy added to employer’s liability insurance guards against these types of employee claims, and can cover the cost of hiring a lawyer or any resulting settlement after the underlying policy’s limits are reached.

Top professions we insure

What does commercial umbrella insurance not cover?

While umbrella insurance does expand coverage limits for a number of policies, it does not provide all the protection that a small business might need.

For instance, an umbrella policy generally doesn’t cover the following exclusions:

Damages within the underlying policy limits

Umbrella liability insurance does not become active until the underlying policy has reached its limits. And as with any policy, it does not provide coverage beyond its own policy limits.

Business property damage

Business umbrella insurance can only be added to liability policies, not property insurance.

The commercial property insurance portion of a business owner’s policy (BOP) or commercial package policy (CPP) can help pay for repair or replacement when your business property is damaged by fire, theft, or covered weather-related events.

Professional errors

Professional liability insurance, also called errors and omissions (E&O) insurance or malpractice insurance, can cover lawsuits over professional mistakes, including undelivered services and missed deadlines.

You can boost the limits on this policy with excess liability insurance, also called excess E&O, which is very similar to umbrella insurance.

Employee theft

Commercial crime insurance, a type of fidelity bond, is needed to financially protect your business from criminal acts committed by employees against customers or clients.

Unlike insurance, bonds only reimburse damages up to the size of the coverage that was purchased. Umbrella insurance could not be used to provide coverage beyond that limit.

FAQs about commercial umbrella insurance

Get answers to frequently asked questions about commercial umbrella coverage

How much commercial umbrella insurance do you need?

Businesses usually purchase an umbrella policy to fulfill contracts calling for limits of more than $2 million. Contracts of up to $5 million are not uncommon. In that case, an umbrella policy with a limit of $3 million would be added to a policy with a $2 million limit to meet the requirement.

Otherwise, the amount depends on your industry and your business needs. For example, you may want to secure more coverage to protect a team of construction workers.

As you compare umbrella insurance quotes and consider your options, keep these three things in mind:

- You can’t buy umbrella insurance without having at least one other policy. You need to have general liability, employer’s liability, or commercial auto liability insurance before you can get umbrella coverage.

- Umbrella insurance doesn’t work with commercial property insurance. While it does boost three other policies, umbrella insurance can’t be used to help with business property damage.

- Umbrella insurance comes in $1 million increments. Small business owners can increase their lawsuit protection in $1 million increments, which means you can buy the exact coverage you need.

What is the difference between commercial umbrella insurance and excess liability insurance?

You may see the terms commercial umbrella insurance and excess liability insurance used interchangeably, but they’re not the same.

Excess liability insurance provides additional coverage for just one of your business liability policies, usually general liability insurance or E&O insurance.

Commercial umbrella insurance provides coverage across several liability insurance policies when there’s a claim against your business that exceeds its limits.

Where can I learn more about commercial umbrella insurance?

If you want to learn more about this policy, you can find additional answers in our frequently asked questions about commercial umbrella insurance.

If there are any additional questions you have about coverage, you can also contact an Swift agent.

Commercial umbrella insurance cost

The cost of commercial umbrella insurance varies based on a number of factors about your business. Your premium is directly impacted by your level of risk, how much coverage you buy, and more.

What is the average cost of umbrella insurance coverage?

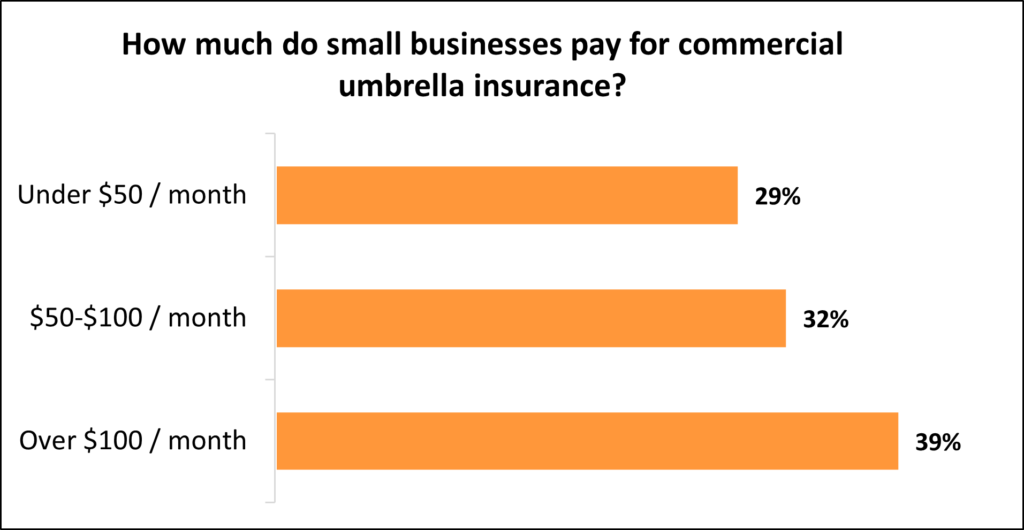

Small businesses pay an average premium of $75 per month, or about $900 annually, for commercial umbrella insurance.

Our figures are sourced from the median cost of policies purchased by Swift Insurance customers from leading insurance companies. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Commercial umbrella insurance boosts liability coverage when you reach the maximum policy limit on your underlying general liability insurance, commercial auto insurance, or employer’s liability insurance. Most small businesses purchase this extra coverage as a way to meet a client’s demands for limits in excess of $2 million.

Typical commercial umbrella insurance costs for Swift Insurabce customers

While Swift’s small business customers pay an average of $75 monthly for commercial umbrella insurance, 29% pay less than $50 per month and 32% pay between $50 and $100 per month.

The cost varies for small businesses depending on their risks and the amount of coverage they choose.

Understanding commercial umbrella insurance cost factors

Get answers to frequently asked questions about umbrella insurance.

How do policy limits affect commercial umbrella insurance costs?

The cost of umbrella insurance increases with the amount of insurance coverage. In short, you’ll pay more for higher liability limits.

Generally, it costs about $40 per month for each $1 million of additional coverage you buy. For example, raising the limits on your general liability insurance from $2 million to $5 million might cost an additional $120 per month over the cost of the underlying policy.

Commercial umbrella insurance boosts your limits across several liability policies. If you only need coverage added to one liability insurance policy, then you could purchase excess liability insurance.

To select the most cost-effective policy for your business, take stock of the potential liabilities you face and see if your business needs the extra protection that commercial umbrella insurance provides.

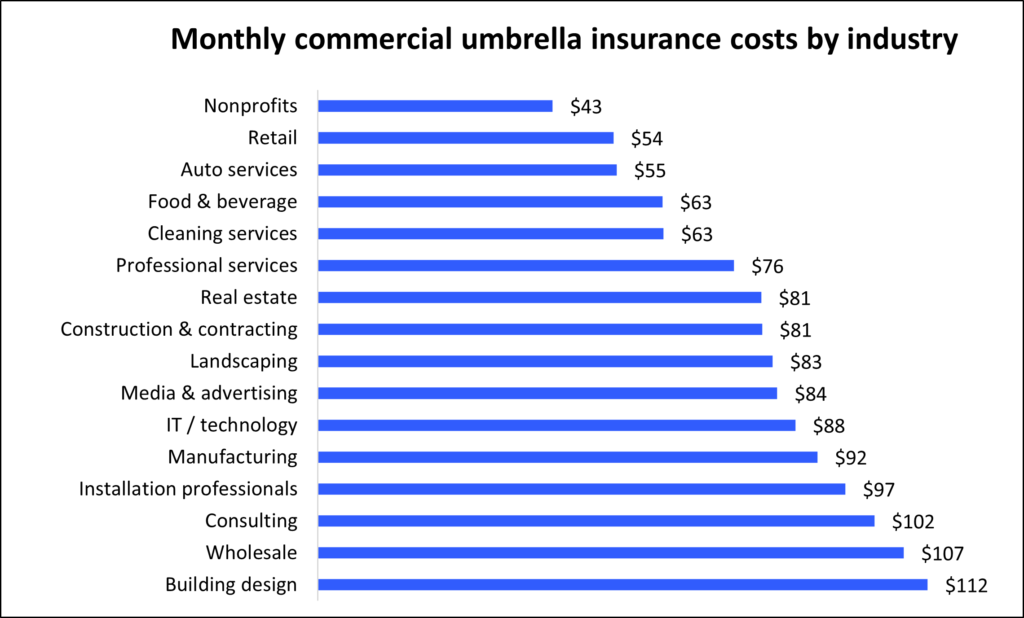

How does your industry impact the cost of umbrella liability insurance?

Our analysis of commercial umbrella insurance providers reveals that for small businesses, your industry has the biggest impact on your premium. Businesses in industries that are vulnerable to costly lawsuits may need higher limits than those with limited liability, and will pay a higher premium for umbrella insurance.

For example, building design professionals pay an average of $112 monthly for umbrella coverage, while nonprofits pay an average of only $43 per month. The graph below illustrates how the type of business affects what you’ll pay for a commercial umbrella insurance policy.

Depending on the industry that you work in, such as construction or cannabis, you may be required by your state to carry general liability insurance. For other businesses, such as those in real estate, insurance, or healthcare, you may need professional liability insurance (also called errors and omissions insurance) before you can get a license.

What other factors influence the cost of business umbrella insurance?

The cost of umbrella insurance depends on your underlying coverages and their associated risks, such as:

- Your business is open to the public and experiences lots of foot traffic, which increases the chance of a claim on your general liability policy.

- You regularly handle customer property, which places you at risk of a property damage lawsuit.

- You own a fleet of heavily used commercial vehicles, which increases the chance of an auto liability claim.

- Your industry includes risky work that places your employees at risk of bodily injury, and you at risk of employer’s liability lawsuits and costly medical bills.

Are there any exclusions to umbrella insurance coverage?

You can only buy an umbrella policy for general liability, commercial auto, and employer’s liability policies. You must first buy one or more of these policies before you can buy umbrella coverage for each one.

Other business insurance coverages, such as workers’ compensation, cyber insurance, and commercial property insurance, are excluded from umbrella coverage.

Top industries we insure

A commercial umbrella policy boosts your liability protection at an affordable price

Commercial umbrella insurance increases the coverage limits of your underlying insurance policies in $1 million increments. It’s fairly common for a client’s contract to call for a $5 million limit on a policy. In that case, an umbrella policy with a limit of $3 million would be added to a business liability policy with a $2 million limit to reach the total requested amount.

It’s important to make sure you’re fully protected against the high costs of a lawsuit. At any business, a visitor could trip and suffer an injury. The resulting legal and medical expenses might escalate to the point where they could sink your business.

Even if no one outside your company visits your office, someone could still hold your business liable for damages. For example, businesses that run advertising campaigns or post on social media could face a lawsuit if they post content that doesn’t belong to them, or make a false claim about a competitor.

When someone sues your business – even if it’s a frivolous lawsuit – you’ll have to pay legal defense costs, such as the cost of hiring an attorney. If you lose the suit, you could end up paying a fortune in a court-ordered judgment or a settlement.

Umbrella insurance kicks in when your underlying policy reaches its limit, which could save your business from a devastating loss. Because the premium is based upon your level of risk and how much coverage you buy, small businesses like LLCs and sole proprietorships often pay only a small monthly premium for this coverage.

How can you save money on umbrella insurance?

Pay your entire premium upfront. You can typically pay your premium in monthly or annual installments. It might be tempting to go with a smaller monthly payment, but consider paying the full premium instead. Many insurers offer discounts on annual premiums.

Proactively manage your risks. Umbrella insurance covers your liability risks across several policies, and fewer claims means lower insurance rates. Business owners can create a comprehensive risk management plan to avoid claims. For example, you might:

- Develop a thorough training program for employees

- Invest in a security system

- Compile rules for posting to social media

- Create procedure checklists and reviews

- Minimize hazards on your business premises

- Limit who can drive business vehicles to avoid claims on your auto insurance policy

You can also learn more about saving money on other types of insurance, from our pages on cheap general liability insurance and cheap commercial auto insurance.

Why do small businesses choose Swift Insurance?

Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Frequently asked questions about commercial umbrella insurance

Umbrella liability insurance offers an extra layer of coverage, in case a claim exceeds certain liability insurance policies. Find out how to get a policy, when you need it, and the answers to other frequently asked questions below.

Commercial umbrella insurance requirements and coverage

What does umbrella insurance cover?

Umbrella liability insurance covers claims that exceed the coverage limits on your general liability insurance, employer’s liability insurance, commercial auto insurance, and hired and non-owned auto insurance (HNOA).

It kicks in after a claim exceeds your coverage limit on one of these underlying policies and provides coverage up to the policy limit of your umbrella policy.

What is not covered by an umbrella policy?

An umbrella liability policy doesn’t cover excess claims against professional liability insurance (also known as errors and omissions insurance, or E&O), medical malpractice insurance, commercial property insurance, or commercial crime insurance.

How do commercial umbrella limits work?

Commercial umbrella insurance provides added liability coverage in case you have a claim that exceeds the coverage limits of an underlying policy.

For example, imagine if you had a $1 million per-occurrence limit on your general liability policy, and a customer sues you over an accident that occurred at your business location. The medical bills, legal expenses, and damages from this accident could add up to $1.5 million, which would then exceed the limit on your general liability coverage.

If you had an umbrella policy, it would cover that excess $500,000 liability, up to the coverage limit of your umbrella insurance.

How much umbrella insurance do I need?

That depends on the size of your business, your liabilities, and any contractual obligations you have with clients. For example, if a contract requires you to have $5 million in general liability coverage, you could buy $2 million of general liability insurance with a $3 million umbrella policy to meet that obligation.

Umbrella insurance is available in $1 million increments. Keep in mind that you must have an underlying policy, such as general liability or commercial auto insurance, before you buy umbrella coverage.

If you’re unsure how much coverage you need, you can chat with a licensed insurance agent.

Why do I need a commercial umbrella policy?

There are many reasons why you may need commercial umbrella coverage:

- It’s an affordable way of increasing your liability coverage to qualify for contracts

- Your business relies on a lot of foot traffic, which increases the risk of a lawsuit over slip-and-fall accidents and other mishaps

- Your work involves hazardous conditions, such as in construction or manufacturing, that could result in an employee injury

- You rely on business vehicles that spend a lot of time on the road, increasing your chance of an accident and a lawsuit

How to buy umbrella insurance coverage with Swift Insurance

How quickly can I get commercial umbrella coverage with Swift Insurance?

By providing basic information about your business, such as its location, the number of employees, and estimated revenue for the upcoming year, we’ll be able to give you multiple quotes from top U.S. carriers.

Our online application takes just a few minutes to complete, so that you can compare coverage and find the right policy for your business just moments after submitting your information. A licensed Swift agent can also help you through this process.

Once you purchase coverage, it typically takes 24 to 48 hours to complete the process and receive your proof of insurance.

How much does an umbrella policy cost?

Commercial umbrella insurance typically costs around $40 per month for every $1 million of liability coverage.

For Insureon customers, the average premium is $75 per month for umbrella insurance, or $900 per year.

Some small businesses (29%) pay less than $50 per month for umbrella coverage and about a third (32%) pay between $50 and $100 per month.

Which industries most often purchase umbrella liability insurance?

A variety of small business owners rely on umbrella insurance as an affordable way to increase their liability coverage and protect their bottom line.

This includes:

- Auto services and dealers

- Cleaning businesses

- Manufacturing businesses

- Real estate professionals

- Retail businesses

- Wholesale and distribution businesses

Umbrella insurance claim and settlement process

When am I able to make an umbrella liability claim?

Your umbrella insurance is there whenever you face a claim that exceeds the coverage limits of an underlying policy, such as general liability, commercial vehicle, etc.

This could happen whether the underlying policy’s per-occurrence or aggregate limits are exceeded. Your per-occurrence limit is for individual claims. Your aggregate limit applies to all claims within a policy year.

How do I make an umbrella insurance claim?

Call your insurance provider. An agent will ask you some basic information about the incident such as where it happened and your policy number. The agent can walk you through the claims process and answer any additional questions.

Umbrella insurance policy changes

What happens if I need to buy more insurance later?

Just call your insurance provider and tell them you need more coverage. The agent can then adjust your coverage amount and tell you what your new premium will be.

What happens if I cancel my policy?

If you cancel your policy before its expiration date, you’ll likely have to pay more in premiums to buy coverage later on. You also put yourself at risk of an expensive lawsuit or claim that you’d have to pay out-of-pocket.

Compare umbrella liability insurance with other policies

What is the difference between commercial umbrella insurance vs. excess liability insurance?

Excess liability insurance provides additional coverage for a single liability policy, such as your general liability coverage or your errors and omissions insurance. Your excess liability coverage kicks in when you exceed the policy limits on that underlying policy.

Commercial umbrella insurance provides additional coverage for many of your liability insurance policies. It also kicks in when you exceed the policy limits on one of these policies.

What is the difference between umbrella liability insurance vs. general liability insurance?

General liability insurance coverage gives you financial protection from specific business risks such as customer injury, damage to a customer’s property, and advertising injury. It does not apply to any other policy.

Umbrella liability insurance can apply to many of your liability insurance policies such as general liability, employer’s liability insurance, commercial auto insurance, and hired and non-owned auto insurance. Your umbrella coverage is there in case you have a claim that exceeds the coverage limits of one of these underlying policies.