Choose from the nation's best insurance providers

Tools and Equipment Insurance

Contractor's tools and equipment insurance

This policy helps pay for repair or replacement of a contractor’s tools and equipment if they are lost, stolen, or damaged. The items typically must be less than five years old.

Why is contractor's tools and equipment insurance important for small businesses?

Contractor’s tools and equipment insurance is a form of inland marine insurance for small tools and equipment.

Also called equipment floater insurance or tool insurance, it’s designed for construction and contracting companies and installation professionals who work at different job sites, unlike standard commercial property insurance policies that typically only cover items that stay at a fixed business address.

It protects movable tools and equipment wherever you take them, and pays for repair or replacement if they are lost, damaged, or stolen. However, it does not cover general wear and tear.

Protect your tools on-the-go

This coverage is designed for business equipment that travels with you to job sites. Specifically, it covers:

- Items valued at under $10,000

- Items that are less than five years old

You can often add this coverage to commercial property insurance or a business owner’s policy (BOP).

What does contractor’s tools and equipment insurance cover?

Contractor’s tools and equipment insurance protects hand tools, power tools, machinery, and other equipment that moves from place to place. The items typically must be relatively new and inexpensive.

A covered financial loss under this policy includes a variety of items and incidents, including the following:

Stolen tools

Contractor’s tools and equipment insurance can provide reimbursement for hammers, saws, and other employee tools stolen from a worksite, a client’s home or business, or a storage unit. It also covers items stolen in transit.

Broken or damaged equipment

This policy can cover the cost of replacing a broken tool or repairing a piece of equipment that has been damaged. However, it does not cover normal wear and tear.

Vandalism

Contractor’s tools and equipment insurance covers the cost of removing graffiti and repairing equipment damaged by vandalism.

Leased or rented items

Some policies include protection for contractors who lease or rent equipment. That could include coverage for equipment that you rent for a project, or while you wait for repair of damaged equipment.

How much does contractor’s tools and equipment insurance cost?

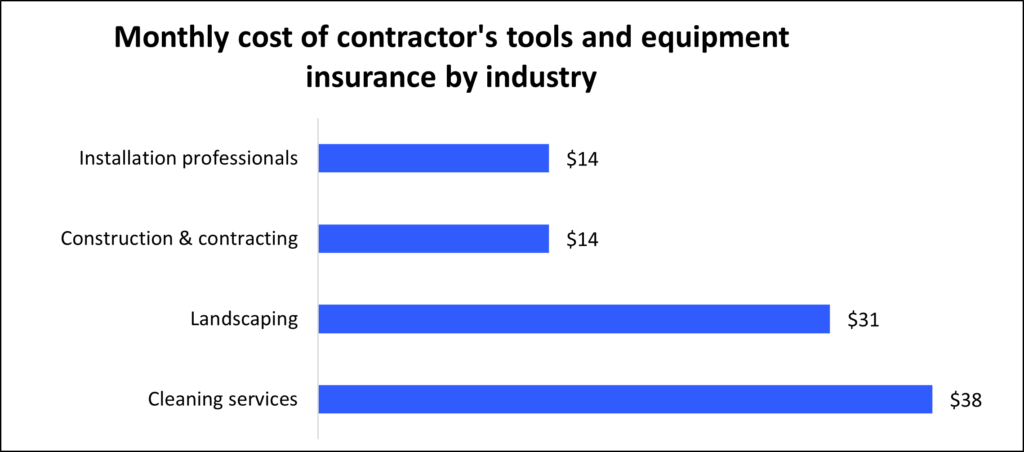

Because it covers items valued at under $10,000, this policy is very affordable. Small business owners pay an average premium of only $14 per month.

Factors that affect the cost of contractor’s tool and equipment insurance include:

- Industry risk

- Value of your tools and equipment

- How often items are moved

- Coverage type (named perils or open perils)

- Claims history

- Property valuation method

- Policy limits, deductible, and other coverage options

Who needs contractor's equipment coverage?

A standard commercial property insurance policy won’t cover tools in transit or equipment stored at a worksite. It’s risky to move items and store them off-site, which is why you may need additional coverage.

Contractor’s tools and equipment insurance benefits a wide range of professionals who bring tools and equipment to job sites. Both small business owners and independent contractors should consider carrying this coverage.

Businesses that purchase this property coverage include:

Construction businesses

If your toolbox is stolen from a client’s backyard, or a recently purchased scissor lift breaks during a project, contractor’s tools and equipment insurance covers its repair or replacement cost. The damage could happen while your belongings are in transit or in storage away from your business office.

For example, say an electrician’s toolbox disappears while left overnight at an office worksite. Contractor’s tools and equipment insurance would cover the cost of purchasing a new toolbox and replacing the tools that were stolen.

Installation businesses

Installation professionals depend on this policy to protect their tools and equipment left at a client’s home, office, or other property during a project.

For example, it could cover the cost of replacing a fence installer’s post hole digger stolen from a client’s yard, or an appliance installer’s adjustable wrench set stolen from their van.

Landscaping businesses

Because they work at different outdoor locations, landscapers need contractor’s tools and equipment insurance to protect their lawnmowers, leaf blowers, and other tools of the trade.

This policy covers the cost of rakes and hedge trimmers stolen from your pickup, or a replacement lawnmower if yours breaks unexpectedly.

Travel and outdoor storage are both risky, which is why this coverage is so important for tree service professionals, lawn care companies, and others who bring their work equipment with them everywhere they go.

Top professions that need contractor's tools and equipment insurance

What does contractor’s tools and equipment insurance not cover?

Contractor’s tools and equipment insurance is ideal for businesses that operate on a small budget. However, it doesn’t cover every instance of property damage, and it’s not designed for certain types of equipment.

Here are a few examples of common exclusions:

Wear and tear

Items damaged by general wear and tear, such as a lawnmower’s blade that dulls over time, are not covered by contractor’s tools and equipment insurance.

Breakage or misuse

Deliberate breakage or misuse are also not covered by this policy. For example, if a worker tries to suck up a large puddle with a leaf blower vacuum, your policy won’t cover the resulting water damage.

Older items

Items that are more than five years old are typically not eligible for coverage.

Expensive items

Items valued at more than $10,000 are also not covered by this policy. For example, it might cover a small, low-powered tractor, but not a top-of-the-line one.

Vehicles

Vehicles owned by your business should be covered by commercial auto insurance. Hired and non-owned auto insurance (HNOA) is the right policy for leased, rented, and personal vehicles used for work purposes.

How can I purchase contractor's tools and equipment insurance?

Complete Swift’s easy online application today to compare contractor’s tool and equipment insurance quotes from top-rated U.S. carriers. Our expert insurance agents can help you find the best coverage for your small business insurance needs.

Once you find the right policies for your small business, you can get coverage quickly and receive a copy of your certificate of insurance in less than 24 hours.

Find general liability insurance quotes

FAQs about contractor's tools and equipment insurance

Review answers for frequently asked questions about contractor’s tools and equipment coverage.

Can contractor’s equipment coverage be added to a BOP?

If you’re a small business owner or a contractor, you may be able to add contractor’s tools and equipment coverage to your business owner’s policy.

A BOP bundles general liability insurance with commercial property insurance, usually at a lower premium than purchasing each policy separately. Some insurance providers will also let you add business interruption insurance to a BOP.

How does contractor’s tools and equipment coverage work?

With contractor’s tools and equipment insurance, you have the option of insuring your tools and equipment for their replacement value or their actual cash value.

Insuring for the replacement cost helps pay for the purchase of a brand-new item to replace any equipment that was lost or damaged at a worksite.

With actual cash value, on the other hand, an insurance company will provide reimbursement for the compromised equipment by looking at the item’s current market value and then factoring in depreciation from the number of years that the item was used.

Because of this, a policy insured with actual cash value will typically cost less than one insured with replacement cost.

What is the difference between contractor's tools and equipment coverage and inland marine insurance?

Simply put, it depends on the items you wish to insure. Contractor’s tools and equipment insurance is designed for items valued at less than $10,000. Specialized equipment or heavy machinery may require inland marine insurance.

If you’re looking at an item like a costly bulldozer, backhoe, or excavator, inland marine insurance is likely the appropriate policy. If you only need insurance coverage for lawnmowers, saws, or hand tools, then contractor’s equipment insurance should be enough.

There’s also equipment breakdown insurance, which is designed for machinery or equipment that suffers a mechanical failure at your business.

If you’re unsure which type of policy you need or have questions about other insurance products, consult a licensed insurance agent who can help you find the right equipment insurance policy for your small business.

Tools and equipment insurance cost

The cost of tools and equipment insurance varies based on a number of factors about your business. Your premium is directly impacted by the type of equipment you wish to insure, your policy limits, industry risk, and more.

What is the average cost of equipment insurance?

Small businesses pay an average premium of $14 per month, or about $170 annually, for tools and equipment insurance.

Our figures are sourced from the median cost of policies purchased by Swift Insurance customers from leading insurance companies. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Understanding tools and equipment insurance cost factors

Here are a few factors that your insurance provider will consider when determining your premium for a tool insurance policy:

Coverage limits

A tools and equipment policy is property coverage for newer items valued at $10,000 or less. It’s designed for items that are stored offsite or that travel to job sites, such as hand tools, power tools, saws, etc. Generally, the cost of your policy depends on the value of the items that you wish to insure.

Your coverage limit should match the value of the items you are insuring to guarantee you don’t end up paying for property damage out of pocket. Mobile items valued at more than $10,000, such as bulldozers, excavators, backhoes, and other heavy equipment, will require inland marine insurance coverage.

Property valuation method

When buying property insurance, you can choose to cover your property for its replacement cost or its actual cash value. Replacement value coverage costs more because it pays for the purchase of a brand-new replacement item. You can save money with actual cash value coverage, which instead covers the item’s depreciated value.

Types of hazards covered

An equipment policy that covers open perils will cost more than a policy that covers named perils. Open perils coverage protects against all losses, except those specifically excluded in the policy. Named perils coverage only protects against losses listed in the policy.

Typically, tools and equipment insurance covers fires, vandalism, theft, and hail damage. Exclusions may include earthquakes, floods, equipment breakdown, and vehicle damage, which can be covered by commercial auto insurance.

Safety and security

Insurance providers will assess how safe your items are when determining your premium. For example, office equipment stored at a secure offsite location will cost less to insure than employee tools stored at a construction project in an area of high crime.

Additionally, insurers may look at how often the items are moved, as well as safety features like sprinkler systems and burglar alarms.

Industry risks

Insurance companies will also look at your industry and profession when determining the cost of any type of commercial property insurance. Small businesses in professions with higher risks and more frequent property claims can expect to pay more for this coverage.

For example, cleaning businesses pay an average of $38 per month for tools and equipment coverage, as they may face a higher risk of damaged or stolen items at a client’s premises. General contractors and construction businesses, on the other hand, pay an average of only $14 per month for this policy.

The graph below illustrates how your type of business can affect the premium.

Top industries we insure

How can you save money on a tools and equipment insurance policy?

It’s easy to save money on your tools and equipment policy without compromising on coverage.

Some strategies to keep costs down include:

- Bundle policies. Many small business owners opt for a business owner’s policy (BOP) or commercial package policy (CPP), which combines commercial property insurance with general liability coverage at a lower rate than purchasing each policy separately.

- Pay the annual premium. When you buy a tools and equipment policy, you can choose to pay your premium in monthly installments or annually. Insurers usually offer a discount when you pay the full annual premium.

- Manage your risks. Insurers will consider your claims history when setting your premium. Risk management helps you avoid claims and keep your premium low. That includes choosing a secure site to store your items, or installing a burglar alarm on a van or truck.

- Choose cheaper coverage options. Opting for lower limits or a higher deductible is an easy way to save money on your premium. However, be sure to choose a deductible you can easily afford. If you can’t pay your deducible, you can’t collect on a claim.

Why do small businesses choose Swift Insurance?

Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.