Choose from the nation's best insurance providers

Business owner’s policy

Business owner’s policy

A business owner’s policy (BOP) bundles general liability insurance with commercial property insurance. It typically costs less than purchasing policies separately.

Who needs a business owner's policy?

If you own or rent a workspace, you likely need a business owner’s policy (BOP).

Most small businesses need general liability insurance and commercial property insurance when they rent or own an office or other commercial space. On top of that, client contracts often require general liability coverage.

Even when coverage isn’t required, a BOP is a wise choice for small businesses that work directly with the public and own valuable business property. This policy protects against financial losses from customer accidents and incidents like fires and burglaries.

Is your business eligible for a business owner's policy?

To qualify for BOP savings, businesses typically must have:

- A low-risk industry

- Fewer than 100 employees

- Less than $1 million in annual revenue

- A small commercial space

What does a business owner's policy cover?

A business owner’s policy includes both general liability insurance policy and commercial property insurance coverage, sometimes called business hazard insurance. Together, they provide liability and property coverage for your small business.

Specifically, a BOP will typically cover:

Third-party bodily injury

If a customer is hurt on your property, the general liability insurance portion of your business owner’s policy can help pay for medical expenses or legal expenses in the event of a lawsuit.

Third-party property damage

The general liability portion of a BOP can help repair or replace damaged customer property. It can also pay legal fees if a customer sues over the damage.

Product liability

Property damage or customer injuries don’t have to happen on you or your client’s property. If a business manufactures, distributes, or sells products, it can be sued over the harm those products cause to people or property. Having product liability coverage in a BOP can provide protection from these types of risks.

Advertising injuries

If someone sues a business owner or employee over an advertising injury, such as libel, slander, or copyright infringement, the liability portion of a BOP can help pay for lawsuit expenses.

Business property damage

The commercial property insurance portion of a BOP can help pay for expenses to repair or replace your business property if it’s damaged by fire, theft, and some weather-related events.

This policy’s business personal property (BPP) coverage provides protection for items that are used to run a business, such as furniture and machinery.

How much does a business owner's policy cost?

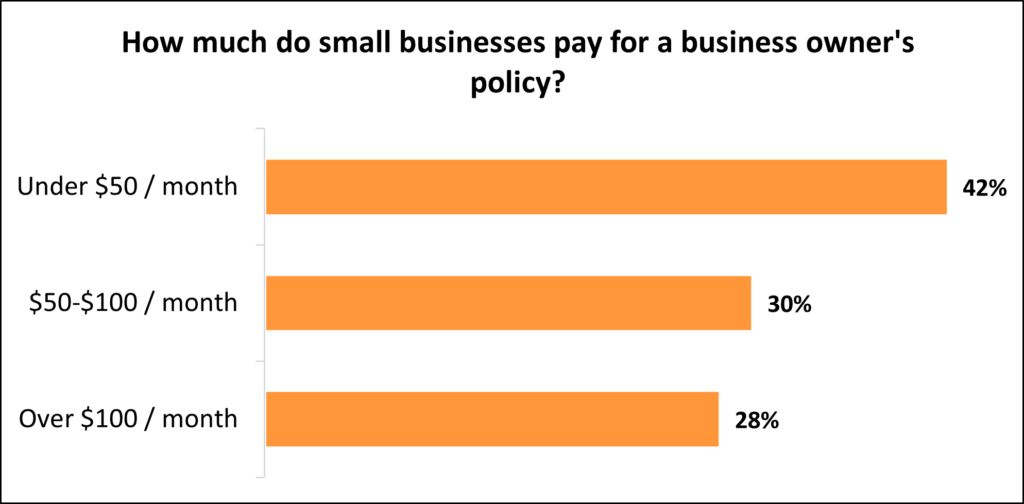

Business owner’s policies cost an average of $57 per month. 42% of Insureon’s small business policyholders pay less than $50 per month for this policy.

Your insurance cost is based on a few factors, including:

- Amount of coverage

- Business property value

- Industry and business operations

- Business location

- Number of employees

- Claims history

Protect your small business with a BOP

Swift Insurence helps a wide range of businesses get the coverage they need from top-rated U.S. insurance carriers. Complete our easy online application to get free small business insurance quotes.

Our expert insurance agents can help you choose the best best business owner’s policy that meets the needs of your small business.

You’ll typically be able to get coverage quickly and receive a copy of your insurance certificate on the same day.

Top professions we insure

What does a BOP not cover?

While business owner’s insurance can help bundle coverage for a variety of business risks, it does not provide all the protection that a small business needs.

Specifically, a BOP will not include coverage for:

Employee injuries

Workers’ compensation insurance covers medical expenses, physical therapy, and some lost income for employees who are injured at work. It’s required in most states for businesses with employees.

Employee discrimination lawsuits

Employment practices liability insurance (EPLI) can cover lawsuit expenses related to claims of harassment, discrimination, and wrongful termination.

Vehicles used by a business

Commercial auto insurance provides coverage for business vehicles. It’s required in most states when your business owns the vehicle or you use it primarily for work.

Destroyed payment records

If a fire or other incident destroys your customer records, you could have trouble collecting outstanding payments. This is not a covered loss of commercial property insurance, unless your policy has an accounts receivable endorsement.

Get business owner's policy quotes

FAQs about a business owner's policy

Get answers for frequently asked questions about a business owner’s policy

Is it possible to add coverage to a BOP policy?

Yes. Business owner’s policies are flexible. You can add additional coverages, also called endorsements, to your BOP insurance to meet your specific needs.

Many businesses bundle their BOP with other types of business coverage options, such as:

Business interruption insurance (also known as business income insurance) covers loss of income and extra expenses when there is a temporary disruption in your business operations.

Business renter’s insurance is a type of insurance bundle that covers your rented business space in the event of fire, vandalism, or weather damage. It is similar to the renter’s insurance that many apartment occupants have.

Contractor’s tools and equipment insurance, a form of inland marine insurance, covers business property in transit. It can provide protection for a general contractor or handyman who transports tools and equipment to different job sites.

Data breach insurance (also known as cyber insurance) helps retail stores and other businesses recover when a data breach exposes customer data like credit card numbers.

Electronic data processing (EDP) insurance helps cover your electronic data processing equipment, such as computers and backup systems, against data loss during a power surge, fire, natural disaster, or similar incident.

Electronic data liability coverage expands your property damage coverage to include a loss of data caused by accidental damage to a customer’s computer, hard drive, or other data storage equipment. While cyber liability insurance usually covers data lost from a targeted software attack, electronic data liability insures a data loss when there’s accidental physical damage to a network or storage device.

Employee dishonesty insurance protects your business from employee theft, such as an employee stealing from the cash register or forging a check.

Employment practices liability insurance (EPLI) can pay for legal costs if a business is sued by an employee over wrongful termination or another violation of employee rights.

Hired and non-owned auto insurance (HNOA) provides coverage for leased and personal vehicles that a business owner occasionally uses for commercial purposes like visiting clients.

Liquor liability insurance protects bars and restaurants if they serve alcohol to an intoxicated person who goes on to cause property damage or harm someone else.

Professional liability insurance (also known as errors and omissions insurance or E&O) protects businesses when a client disputes the quality of a professional service.

If you serve large clients or run a high-risk business, you can add commercial umbrella insurance to your business owner’s policy. Umbrella insurance extends your maximum general liability limits, meaning your insurance company can cover more expensive lawsuits.

What is the difference between general liability coverage and a business owner's policy?

Businesses that interact with the public rely on a general liability policy to cover third-party lawsuits over bodily injuries and property damage. But this insurance doesn’t cover fire, theft, and other incidents that damage or destroy your property.

A business owner’s policy, on the other hand, provides this same general liability coverage and also pays for damage or loss of your building, equipment, and inventory.

If your business owns valuable property, consider a business owner’s policy. A BOP offers both general liability and commercial property coverage at a lower cost than buying the policies separately. That makes it a smart choice for small business owners.

Learn more about the difference between general liability insurance and a BOP.

What is the difference between a business owner's policy and a commercial package policy?

A business owner’s policy combines general liability insurance and commercial property insurance in one policy, and is usually less expensive than buying the coverages separately. It’s often purchased by small business owners and startups to save money on their liability insurance.

A commercial package policy (CPP) is typically purchased by larger businesses with higher risks, including small or midsize businesses with several employees. A CPP allows you to bundle multiple liability policies together, with more flexibility in terms of the risks covered and their coverage limits.

It also allows you to add endorsements, also known as riders, to increase or modify the types of coverage you have and tailor them to your specific insurance needs.

Having an average premium of $90 per month, a CPP tends to be slightly more expensive than a BOP. Though, your exact cost will depend on several factors, including industry risks.

Learn more about the difference between a business owner’s policy and commercial package policy.

How do you get proof of insurance?

Home businesses, freelancers, and small businesses can all benefit from purchasing a business owner’s policy.

Business owners can usually get proof of insurance online on the same day that they start a business owner’s policy through Insureon.

It can take several weeks for a traditional insurance agency to send a certificate of commercial liability insurance to new customers. That’s an issue for business owners who need immediate proof of insurance to sign a pending contract.

With Insureon, you can quickly provide proof of insurance for the lease or contract you’re planning to sign. If your bank or lessor requires other proof of insurance, you can contact an agent for more information.

What are the exclusions from a business owner's policy?

BOPs have some coverage exclusions. For example, a BOP doesn’t usually pay for property damage caused by natural disasters like earthquakes, hurricanes, tornadoes, and floods. If you need coverage for these events, you’ll need to add a special endorsement to your policy.

A BOP also doesn’t pay legal defense costs for lawsuits involving intentional copyright infringement or willful negligence – which can be criminal offenses. Purposeful customer injury or property damage falls into the same category and isn’t covered by the policy.

Incidents that involve alcohol are also excluded from a BOP. With a liquor liability endorsement, you can get coverage for these claims.

Check with a licensed insurance agent to make sure your business owner’s policy includes all the coverage you need.

Where can I learn more about a BOP?

If you want to learn more about this policy, you can find additional answers in our frequently asked questions about business owner’s policies.

If you have any additional questions about coverage or would like to learn more about which endorsements and types of business insurance policies your small business needs, ask an Swift agent.

Business owner’s policy cost

A business owner’s policy (BOP) bundles general liability insurance and commercial property insurance, usually at a lower cost than if you purchased these policies separately. BOP premiums are calculated based on the policy limits you choose, business property value, and more.

What is the average cost of BOP?

Small businesses pay an average of $57 per month for a business owner’s policy, or about $684 annually.

Our figures are sourced from the median cost of policies purchased by Insureon customers. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Typical business owner's policy costs for Swift Insurance customers

Among Swift’s small business customers, 42% pay less than $50 per month for a business owner’s policy, and another 30% pay between $50 and $100.

The cost varies for small businesses depending on their risks, the value of their business property, and the amount of coverage they choose.

Understanding business owner's policy cost factors

Your insurance provider calculates your BOP premium based on a number of factors, including:

- Your policy limits and deductible

- Location of your business

- Industry and risk factors

- Business property value

- Number of employees

How do coverage limits and deductibles affect the cost of a business owner’s policy?

If you want car insurance that pays for a wide range of damage, you have to pay more for it. The same rule applies to business insurance.

A policy with higher liability coverage limits would cost more in premiums, but reduce your out-of-pocket costs during a claim—regardless of the type of coverage you need.

The most popular business owner’s policy among Insureon customers is the $1 million / $2 million policy. This includes:

$1 million per-occurrence limit. While the policy is active, the insurer will pay up to $1 million to cover any single claim.

$2 million aggregate limit. During the lifetime of a policy (usually one year), the insurer will pay up to $2 million to cover claims.

The majority of Insureon customers (87%) choose a policy with a $1 million per-occurrence limit and a $2 million aggregate limit. Ten percent of our customers choose a policy with $2 million / $4 million limits, the next most popular choice.

Swift Insurance customers typically choose a deductible of about $500 for a business owner’s policy. You can choose a higher deductible to save money on your premium. However, it should be an amount you can easily afford, as you can’t benefit from your insurance without first paying the deductible on a claim.

How does property value impact the cost of a business owner’s policy?

For the commercial property insurance portion of a BOP, the cost of insurance depends on the value of your business property, its location, and how you choose to protect it.

These are the main factors that determine the cost of property insurance included in a BOP:

Business personal property (BPP) value. To protect your property, the first step is knowing what it’s worth. You’ll need an estimate of your business personal property. The amount will help you determine appropriate limits to make sure you have enough property coverage to pay for stolen, damaged, or destroyed items.

Replacement value versus actual cash value. The cost of a BOP varies depending on how you choose to insure your business personal property. You can insure it for its replacement value (cost when new), or save money by insuring it for its actual cash value (depreciated value).

Location and age. The value of your building and subsequent insurance costs vary dramatically depending on where your business is located. For example, a small retail shop in rural Pennsylvania would cost much less to insure than a similar retail shop in urban California. Old buildings may also incur higher insurance rates as they are more susceptible to damage.

Endorsements. Additional coverages can expand the protection of a BOP at an increased cost. Business interruption insurance covers lost business income due to a temporary closure, while equipment breakdown insurance covers equipment that suffers a mechanical failure. Check with an agent to find out what your policy includes.

While a business owner’s policy is recommended for most small businesses, it doesn’t protect against every risk. For example, most states require by law that small business owners carry workers’ comp if they have employees, and commercial auto insurance if they have business-owned vehicles.

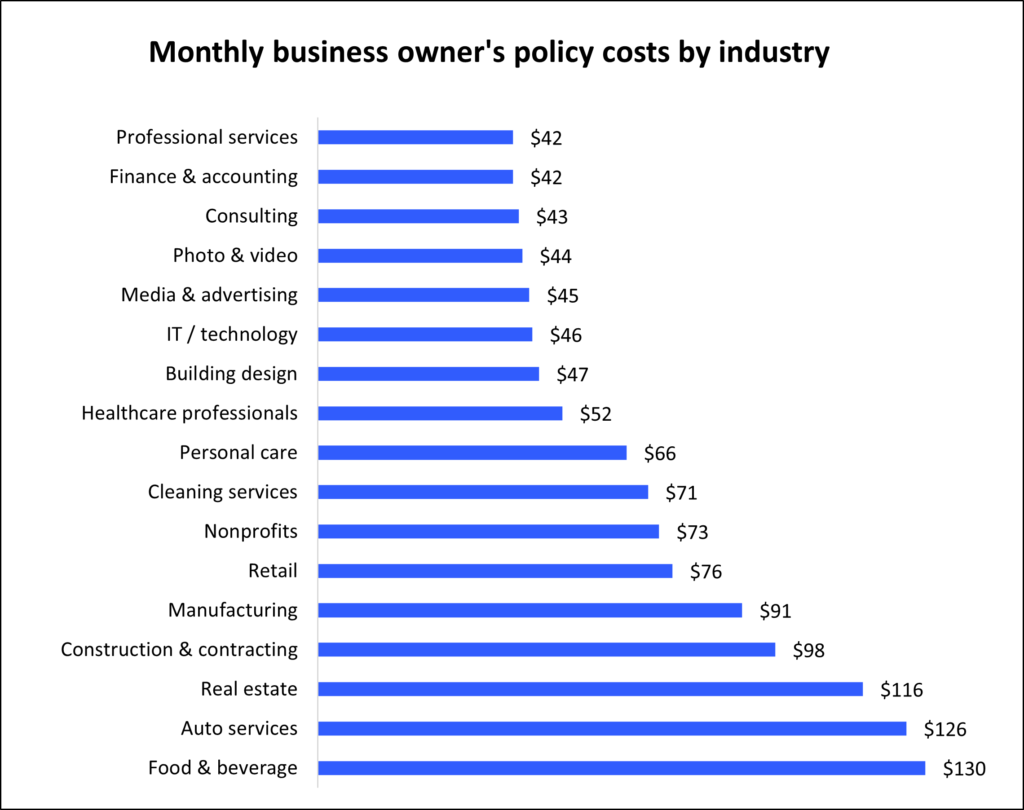

How does your industry impact the cost of a business owner’s policy?

For the general liability insurance portion of a BOP, your industry and the number of employees have a significant impact on policy costs. Generally, high-risk industries, such as retailers with a storefront, pay higher premiums, while low-risk industries enjoy lower rates.

For example, a busy restaurant is exposed to more risk of customer bodily injuries than an IT consultant who works remotely from a home office. Construction businesses, auto services, and retail stores also have high coverage costs because these industries often have valuable equipment or inventory, as well as an increased chance of a third-party liability claim.

The graph below illustrates how the type of business affects what you’ll pay for a business owner’s policy.

Top industries we insure

A BOP provides affordable, necessary protection for your small business

A business owner’s policy is a must-have for small businesses that interact with customers and own business property.

At any business, a visitor could trip and suffer a bodily injury. If the visitor sues, legal costs can escalate to the point where they could sink your business.

Even if no one outside your company visits your office, someone could still hold your business liable for damages. For example, businesses that run advertising campaigns or post on social media could face a lawsuit if they post content that doesn’t belong to them, or make a false claim about a competitor.

When someone sues your business – even if it’s a frivolous lawsuit – you’ll have to pay legal defense costs, such as the cost of hiring an attorney. If you lose the suit, you could end up paying a fortune in a court-ordered judgment or a settlement.

A general liability policy covers all of these costs, which could save your business from bankruptcy. Commercial property insurance covers your building, computers, equipment, tools, and furniture in the event of theft, storm damage, or a fire. A business owner’s policy includes both, safeguarding your business against the most common lawsuits and losses.

Because the premium is based upon your level of risk and the value of your business property, small businesses and contractors often pay only a small monthly premium for a BOP.

How can you save money on a BOP?

Pay your entire premium upfront. Your business owner’s policy premium can typically be paid in monthly or annual installments. It might be tempting to go with a smaller monthly payment, but consider paying the full premium. Many insurers offer a discount when the annual premium is paid in full.

Proactively manage your risks. If your small business has no claims history, expect to pay lower insurance rates. An effective way to do this is to create a comprehensive risk management plan. For example, you might:

- Develop a thorough training program for employees

- Invest in a security system

- Compile rules for posting to social media

- Create procedure checklists and reviews

- Minimize hazards on your premises

Why do small businesses choose Swift?

Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Frequently asked questions about business owner’s policy

A business owner’s policy is one of the most common commercial insurance policies. It’s highly customizable, so the specifics depend on your business. Find out how to get a policy, which businesses are eligible, and the answers to other frequently asked questions below.

Business owner’s policy requirements and coverages

Is a business owner’s policy required by law?

A BOP consists of general liability insurance and commercial property insurance. Neither policy is required by law. However, many of the people you do business with will likely have general liability insurance requirements. You may need this policy if you want to sign a client contract with these requirements. Proof of general liability coverage is also required to apply for certain professional licenses.

Additionally, many commercial landlords require tenants to purchase commercial property insurance, or business renter’s insurance. A landlord might ask to see proof of coverage before you can sign a lease. Commercial landlords themselves often carry lessor’s risk only insurance, which protects against tenant lawsuits over property damage and injuries, as well as building insurance, which covers any buildings, structures, and completed additions that they lease to commercial tenants.

How much BOP coverage do I need?

The amount of BOP coverage you need depends on factors such as the type and size of your business, number of employees, and the type of customers you typically work with. However, many small businesses opt for the standard $1 million / $2 million small business policy. This means the policy will pay up to $1 million to cover any one claim, with a $2 million limit for the lifetime of the policy, which is typically one year.

Can I add non-owned auto insurance to my policy?

Consider purchasing non-owned auto insurance if your employees regularly drive their personal vehicles for business purposes, such as running work errands or traveling to meet clients. This coverage can typically be added to your business owner’s policy.

Does a business owner’s policy cover independent contractors?

A business owner’s policy covers you and your employees, but typically does not include independent contractor insurance coverage. You can either add contractors to your policy on a temporary basis as an additional insured, or require them to purchase their own general liability insurance for contractors policy.

What coverage does a business owner’s policy provide for social media risks?

The general liability portion of your BOP includes what’s known as advertising injury coverage. It provides protection for lawsuits related to libel, slander, and invasion of privacy, as well as copyright or brand infringement. That means if you are sued for writing something negative about a competitor on social media, you’re covered.

How to buy a business owner’s policy with Swift Inurance

How quickly can I get insurance coverage with Swift??

Swift’s online application for a business owner’s policy takes just a few minutes to complete. In most cases, we’ll deliver quotes as soon as you finish the application. Once you purchase a policy, we can email you a certificate of insurance, which is the formal proof-of-insurance document you need to show when you sign certain contracts or apply for professional licenses.

How does Swift’s business owner’s policy application work?

The business owner’s policy application requires some basic information about your business, including where it’s located, number of employees, and estimated revenue for the upcoming year. Since it includes general liability, you’ll need the same application information as you would for general liability – along with information about your business property.

Once you finish the application, you’ll receive quotes from multiple carriers. Look them over and pick the one that works best for you. A licensed Swift insurance agent is available to assist you throughout the process.

How do I get a certificate of liability insurance?

Our certificates of liability insurance are digital. We can email you one as soon as your policy is activated. You can also access your certificate online by logging into your Insureon account.

What types of businesses are eligible for a business owner’s policy?

Insureon specializes in small business insurance for numerous industries. Low-risk businesses with fewer than 100 employees are typically eligible for a BOP.

Our insurance specialists have helped more than 400,000 businesses in fields including:

- Auto services

- Building design

- Cleaning services

- Construction and contracting

- Consulting

- Finance and accounting

- Food and beverage

- Healthcare facilities

- Healthcare professionals

- Human and social services

- Installation professionals

- Insurance professionals

- Landscaping

- Manufacturing

- Media and advertising

- Nonprofits

- Personal care

- Pet care

- Photo and video

- Printing and copying

- Professional services

- Real estate

- Retail

- Sports and fitness

- Therapy and counseling

- Trucking

- Wholesale

Business owner’s policy changes and claims

What happens if I need to buy more insurance later?

It’s easy to add insurance at a later date. Your insurance agent can adjust the coverage amount on an existing policy, and also provide assistance if you need to purchase additional policies.

What happens if I cancel my policy?

If you cancel your policy early, you run the risk of paying more the next time you purchase coverage. Insurance companies typically charge higher rates to businesses that canceled a previous policy. You also leave your business exposed to potential risk if you cancel your coverage.

How do I make a general liability or property insurance claim on my BOP?

To make a general liability claim or a property insurance claim, simply call your insurance provider. Your agent will ask you to provide a description of the incident and basic information such as your name, the business name, and your policy number. Your insurance agent can guide you through the process and provide answers to any additional questions.

Compare a business owner’s policy with other policies

Business owner’s policy vs. professional liability insurance

A business owner’s policy offers protection if a third party sues you over a physical injury, property damage, or an advertising injury (libel or slander). Professional liability insurance covers you if you are sued by a client who claims you made a professional mistake that resulted in financial loss. Almost every business owner could benefit from a business owner’s policy. Your type of business will determine if you need a professional liability policy.

Business owner’s policy vs. workers’ compensation insurance

General liability and workers’ compensation insurance can both pay for medical expenses related to injuries at your business. However, the general liability insurance included with your BOP does not cover employee injuries. To extend this protection to your employees, you will need to purchase workers’ comp insurance, which covers the costs associated with employee injuries or illnesses. Depending on which state your business is located in, you may be legally required to purchase workers’ comp coverage.

Business owner’s policy vs. general liability insurance

General liability insurance provides protection against common risks such as customer injury, but it does not include the commercial property insurance that’s included in a BOP, such as coverage for vandalism and theft.

Commercial property insurance, sometimes referred to as business hazard insurance, can pay to repair or replace business property that is damaged, stolen, or destroyed. A BOP typically costs less than if you purchased each policy separately.

Business owner's policy vs. commercial package policy

A business owner’s policy combines general liability insurance and commercial property insurance in one policy, and is usually less expensive than buying the coverages separately. It’s often purchased by small business owners and startups to save money on their liability insurance.

A commercial package policy (CPP) is typically purchased by larger businesses with higher risks, including small or midsize businesses with several employees. A CPP allows you to bundle multiple liability policies together, with more flexibility in terms of the risks covered and their coverage limits.

It also allows you to add endorsements, also known as riders, to increase or modify the types of coverage you have and tailor them to your specific needs.